Can Study Abroad Expenses Be Deducted?

People searching for “can study abroad expenses be deducted” are likely trying to find out if they can deduct their study abroad expenses from their taxes. This is a common question for students who are considering studying abroad, as they may be eligible for a tax deduction if they meet certain criteria. The IRS has a number of rules and regulations regarding the deductibility of study abroad expenses, and it’s important to understand these rules before filing your taxes.

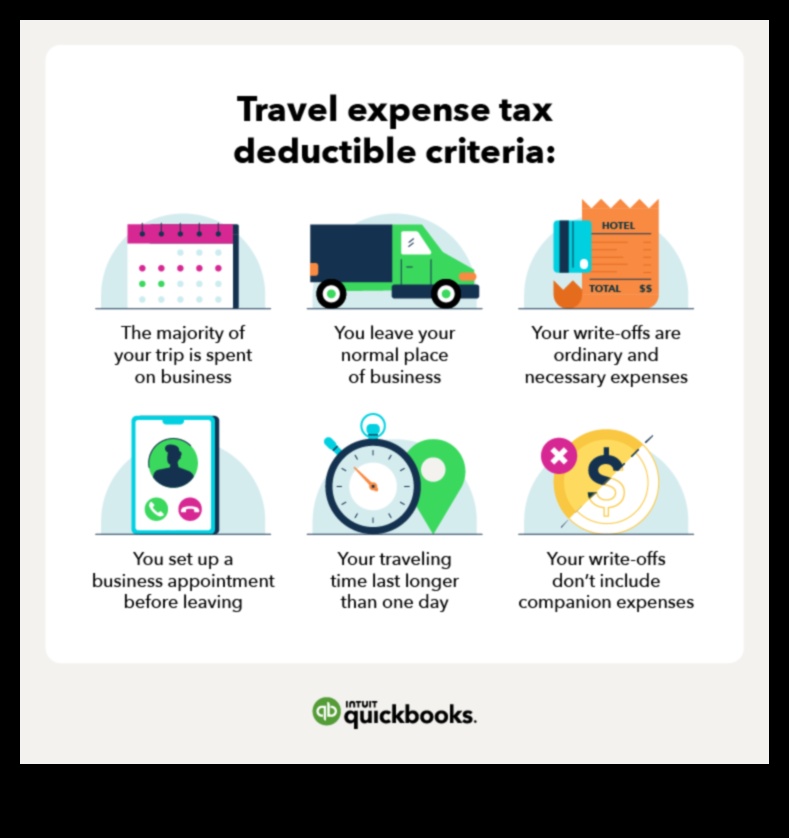

Here are some of the factors that the IRS considers when determining whether or not a student can deduct their study abroad expenses:

- The student’s primary purpose for studying abroad

- The length of the student’s stay abroad

- The amount of money the student spent on study abroad expenses

- The student’s income

If you’re a student who is considering studying abroad, it’s important to do your research and understand the IRS rules and regulations regarding the deductibility of study abroad expenses. This will help you make an informed decision about whether or not studying abroad is right for you.

| Feature | Description |

|---|---|

| Study abroad expenses | Expenses that are incurred in connection with studying abroad, such as tuition, fees, books, and living expenses. |

| Tax-deductible study abroad expenses | Expenses that are eligible for a tax deduction, such as tuition, fees, and books. |

| How much can you deduct for study abroad expenses? | You can deduct up to the amount of your adjusted gross income. |

| How do you claim study abroad expenses on your taxes? | You can claim study abroad expenses on Form 1040, Schedule A. |

II. What are study abroad expenses?

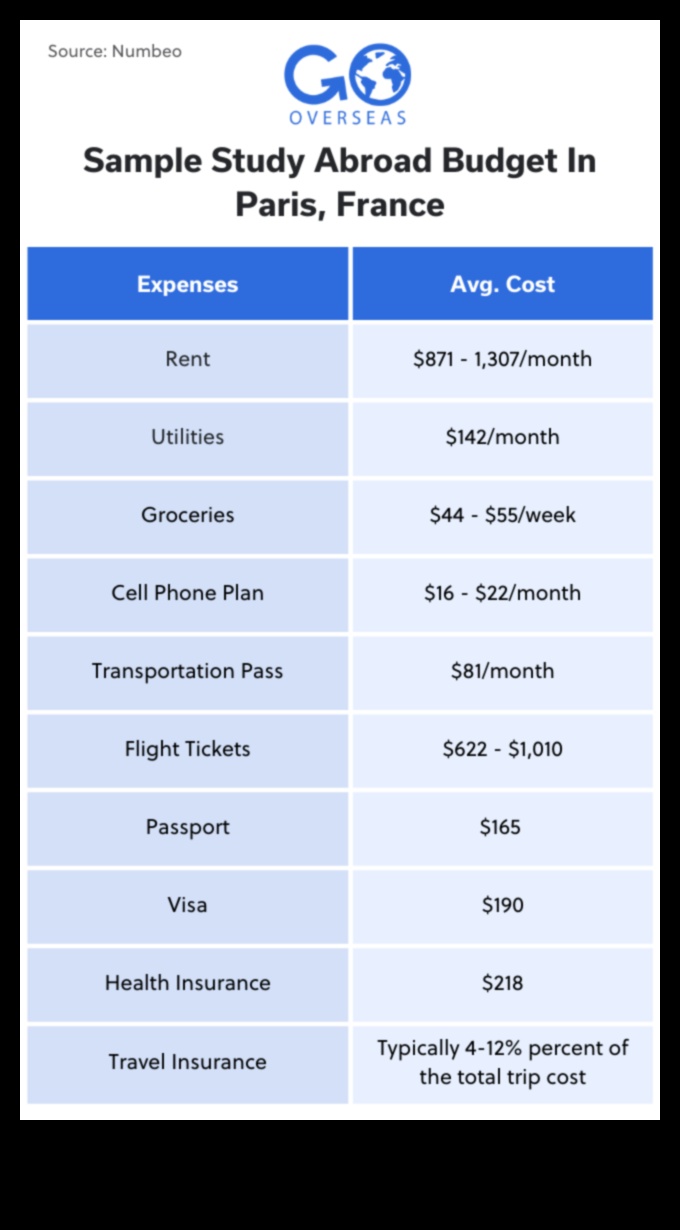

Study abroad expenses are the costs associated with studying at a school or university outside of your home country. These expenses can include tuition, fees, room and board, travel, and living expenses.

III. Which study abroad expenses are tax-deductible?

The following study abroad expenses are generally tax-deductible:

- Tuition and fees

- Books and supplies

- Room and board

- Transportation

- Medical expenses

- Other miscellaneous expenses

However, not all study abroad expenses are tax-deductible. For example, personal expenses such as entertainment, travel, and meals are not tax-deductible.

It’s important to keep track of your study abroad expenses so that you can claim the maximum amount of tax deductions. You should keep receipts for all of your expenses, and you should also keep a journal or diary of your activities while you were studying abroad. This will help you to substantiate your claims and to avoid any potential audit issues.

III. Which study abroad expenses are tax-deductible?

The following study abroad expenses are tax-deductible:

- Tuition and fees

- Books and supplies

- Transportation

- Living expenses

- Health insurance

- Other miscellaneous expenses

It’s important to note that not all study abroad expenses are tax-deductible. For example, personal expenses such as entertainment and travel costs are not tax-deductible.

V. How do you claim study abroad expenses on your taxes?

To claim study abroad expenses on your taxes, you will need to:

- File Form 1040, Schedule A

- Include the amount of your study abroad expenses on line 22 of Schedule A

- Attach Form 1118, Foreign Tax Credit, if you are claiming a foreign tax credit for any of your study abroad expenses

You can find more information about claiming study abroad expenses on your taxes on the IRS website.

VI. Documentation requirements for study abroad expenses

In order to claim a tax deduction for your study abroad expenses, you will need to keep the following documentation:

- A copy of your signed student visa

- A copy of your I-20 form

- A copy of your tuition bill

- A copy of your housing contract

- A copy of your travel receipts

- A copy of your bank statements

You should also keep a diary or log of your activities while you were studying abroad. This will help you to prove that your primary purpose for studying abroad was to further your education.

If you have any questions about the documentation requirements for study abroad expenses, you should consult with a tax professional.

VII. Common study abroad tax deduction mistakes to avoid

There are a number of common mistakes that students make when trying to claim a tax deduction for their study abroad expenses. Here are some of the most common mistakes to avoid:

- Not filing Form 1040NR.

- Not claiming the foreign earned income exclusion.

- Not claiming the foreign housing exclusion or deduction.

- Not claiming the education tax credit.

- Not keeping proper documentation of your expenses.

By avoiding these common mistakes, you can increase your chances of getting the tax deduction that you deserve for your study abroad expenses.

FAQ

Q: What are some common study abroad tax deduction mistakes to avoid?

A: Here are some common study abroad tax deduction mistakes to avoid:

- Not claiming all of your eligible expenses.

- Claiming expenses that are not eligible for a deduction.

- Not keeping proper documentation of your expenses.

- Failing to file your taxes on time.

Q: What is the deadline for claiming study abroad tax deductions?

A: The deadline for claiming study abroad tax deductions is the same as the deadline for filing your taxes. For most people, this is April 15th of the year following the year in which you incurred the expenses.

Q: Can I claim a study abroad tax deduction if I received financial aid?

A: Yes, you can claim a study abroad tax deduction even if you received financial aid. However, you must reduce your expenses by the amount of financial aid you received.

Q: Can I claim a study abroad tax deduction if I took a loan to pay for my expenses?

No, you cannot claim a study abroad tax deduction if you took a loan to pay for your expenses.

Q: I’m a dependent student. Can I claim a study abroad tax deduction?

No, you cannot claim a study abroad tax deduction if you are a dependent student. Only independent students can claim this deduction.

Q: I’m a foreign student. Can I claim a study abroad tax deduction?

No, you cannot claim a study abroad tax deduction if you are a foreign student. This deduction is only available to U.S. citizens and resident aliens.

IX. Conclusion

Studying abroad can be a great way to learn about new cultures, meet new people, and expand your horizons. It can also be a great way to save money on your taxes. If you meet the criteria, you may be able to deduct your study abroad expenses from your taxes. This can save you a significant amount of money, especially if you spent a lot of money on your studies abroad.

Before you file your taxes, be sure to do your research and understand the IRS rules and regulations regarding the deductibility of study abroad expenses. This will help you make sure that you’re eligible for the deduction and that you’re claiming the correct amount of money.

Here are some additional resources that you may find helpful:

- IRS Tax Topic 451: Education

- IRS Publication 970: Tax Benefits for Education

- Tax Deductions for Studying Abroad

FAQ

Q: What are the three most common study abroad tax deduction mistakes to avoid?

A:

- Not claiming all of your eligible expenses

- Claiming expenses that are not tax-deductible

- Not providing the IRS with the correct documentation

Q: What are the three most important things to know about claiming study abroad expenses on your taxes?

A:

- You must be a U.S. citizen or resident alien

- Your expenses must be related to your studies

- You must have receipts for your expenses

Q: What are the three best ways to save money on study abroad expenses?

A:

- Apply for scholarships and grants

- Work part-time while you’re abroad

- Live with a host family or in student housing