How to Get a Small Business Grant

Small business grants can be a great way to help your business grow. They can provide you with the funding you need to start a new business, expand an existing business, or make improvements to your current business.

In this guide, we will discuss everything you need to know about small business grants, including:

- What are small business grants?

- How do I find small business grants?

- What are the eligibility requirements for small business grants?

- How much money can I get from a small business grant?

- What are the different types of small business grants?

- How do I apply for a small business grant?

- What are the benefits of getting a small business grant?

- How can I track the progress of my small business grant application?

By the end of this guide, you will have a better understanding of small business grants and how to get one for your business.

| Topic | Answer |

|---|---|

| Small business grant | A small business grant is a sum of money awarded to a small business by a government agency, nonprofit organization, or private foundation. |

| Grant writing | Grant writing is the process of writing a proposal to request funding from a grantor. |

| Government grants | Government grants are financial awards given by the government to businesses, individuals, or organizations for specific purposes. |

| Small business loans | Small business loans are loans specifically designed for small businesses. |

| SBA | The SBA is a U.S. government agency that provides financial assistance to small businesses. |

II. What are small business grants?

Small business grants are financial awards that are given to small businesses to help them start or grow their businesses. Grants are typically awarded by government agencies, non-profit organizations, or private foundations. They are not loans, so they do not have to be repaid.

Small business grants can be used for a variety of purposes, such as:

- Starting a new business

- Expanding an existing business

- Purchasing new equipment

- Developing new products or services

- Marketing and advertising

Grants can be a great way for small businesses to get the financial help they need to grow and succeed. However, it is important to note that grants are competitive and not all businesses will be eligible for funding.

II. What are small business grants?

Small business grants are financial awards that are given to businesses to help them start or grow their businesses. Grants are awarded based on the needs of the business and the merits of the application.

Small business grants can be used for a variety of purposes, such as:

- Starting a new business

- Expanding an existing business

- Purchasing equipment

- Marketing

- Research and development

Grants can be a great way for small businesses to get the funding they need to grow and succeed. However, it is important to note that grants are not loans, and they do not have to be repaid.

If you are interested in applying for a small business grant, it is important to do your research and find a grant that is a good fit for your business. There are many different types of grants available, and each one has its own eligibility requirements and application process.

You can find more information about small business grants on the following websites:

IV. What are the eligibility requirements for small business grants?

The eligibility requirements for small business grants vary depending on the grant program. However, some common eligibility requirements include:

- The business must be located in the United States.

- The business must be a for-profit business.

- The business must have been in operation for at least two years.

- The business must have a net profit of at least $50,000.

- The business must create new jobs or retain existing jobs.

For more information on the eligibility requirements for specific grant programs, please visit the website of the grant provider.

V. How much money can I get from a small business grant?

The amount of money you can get from a small business grant varies depending on the grant program. Some grants are only a few hundred dollars, while others can be worth tens of thousands of dollars. The size of the grant you receive will depend on a number of factors, including the needs of your business, the competition for the grant, and the funding available.

When you are applying for a small business grant, it is important to be realistic about the amount of money you are likely to receive. If you are hoping to get a large grant, you will need to have a strong business plan and a compelling case for why you need the money.

Here are some tips for getting the most out of a small business grant:

- Do your research and find grants that are a good fit for your business.

- Write a strong business plan that highlights your need for the grant and your ability to use the money effectively.

- Be prepared to compete for the grant.

- Use the grant money wisely to grow your business and create jobs.

VI. What are the different types of small business grants?

There are many different types of small business grants available, each with its own set of criteria and requirements. Some of the most common types of small business grants include:

Government grants: These grants are funded by the government and are typically awarded to businesses that meet certain criteria, such as being located in a low-income area or creating new jobs.

Foundation grants: These grants are funded by private foundations and are typically awarded to businesses that are working on projects that align with the foundation’s mission.

Corporate grants: These grants are funded by corporations and are typically awarded to businesses that are working on projects that align with the corporation’s business interests.

Donor-advised funds: These grants are funded by individuals or families and are typically awarded to businesses that are working on projects that the donor is passionate about.

When you are looking for a small business grant, it is important to understand the different types of grants that are available and to choose one that is a good fit for your business. You should also make sure that you meet all of the criteria for the grant before you apply.

Here is a table that summarizes the different types of small business grants:

| Type of Grant | Funding Source | Criteria |

|—|—|—|

| Government grants | Government | Location, job creation, industry, etc. |

| Foundation grants | Private foundations | Mission alignment, project type, etc. |

| Corporate grants | Corporations | Business interests, project type, etc. |

| Donor-advised funds | Individuals or families | Passion, project type, etc. |

VII. How do I apply for a small business grant?

The application process for small business grants varies depending on the grant provider. However, there are some general steps that you can follow to apply for a grant.

- Identify the grant provider. There are many different organizations that offer small business grants. Do some research to find a grant provider that is offering a grant that is relevant to your business.

- Read the grant guidelines. Each grant provider has its own set of guidelines for applying for a grant. Make sure that you read and understand the guidelines before you start your application.

- Gather the required materials. The grant provider will specify the materials that you need to submit with your application. Make sure that you have all of the required materials before you submit your application.

- Complete the application form. The grant provider will provide you with an application form. Carefully complete the application form and make sure that you answer all of the questions.

- Submit your application. Once you have completed the application form, submit it to the grant provider.

The grant provider will review your application and notify you of the decision. If you are awarded the grant, you will be required to sign a grant agreement. The grant agreement will specify the terms and conditions of the grant.

What are the benefits of getting a small business grant?

There are many benefits to getting a small business grant, including:

- Financial assistance: Small business grants can provide much-needed financial assistance to help you start or grow your business.

- Recognition: Receiving a small business grant can help you to gain recognition in your community and industry.

- Marketing: A small business grant can help you to market your business and attract new customers.

- Opportunity: A small business grant can give you the opportunity to pursue new projects or initiatives that you might not otherwise be able to afford.

- Growth: A small business grant can help you to grow your business and reach new heights.

If you are considering applying for a small business grant, it is important to weigh the benefits of getting a grant against the risks and costs involved. You should also make sure that you are eligible for the grant and that you meet all of the requirements.

IX. How can I track the progress of my small business grant application?

Once you have submitted your small business grant application, you may be wondering how to track its progress. Here are a few tips:

Check the status of your application online. Many government agencies and organizations that offer small business grants have online portals where you can check the status of your application.

Contact the grant administrator. If you cannot find the status of your application online, you can contact the grant administrator directly. They will be able to give you an update on the status of your application and let you know if there is anything else you need to do.

Be patient. The processing time for small business grants can vary, so it is important to be patient. In most cases, you will receive an update on the status of your application within a few weeks or months.

If you have not received an update on the status of your application after a few months, you can contact the grant administrator to inquire about the status. They will be able to tell you if there is anything else you need to do or if your application has been approved or denied.

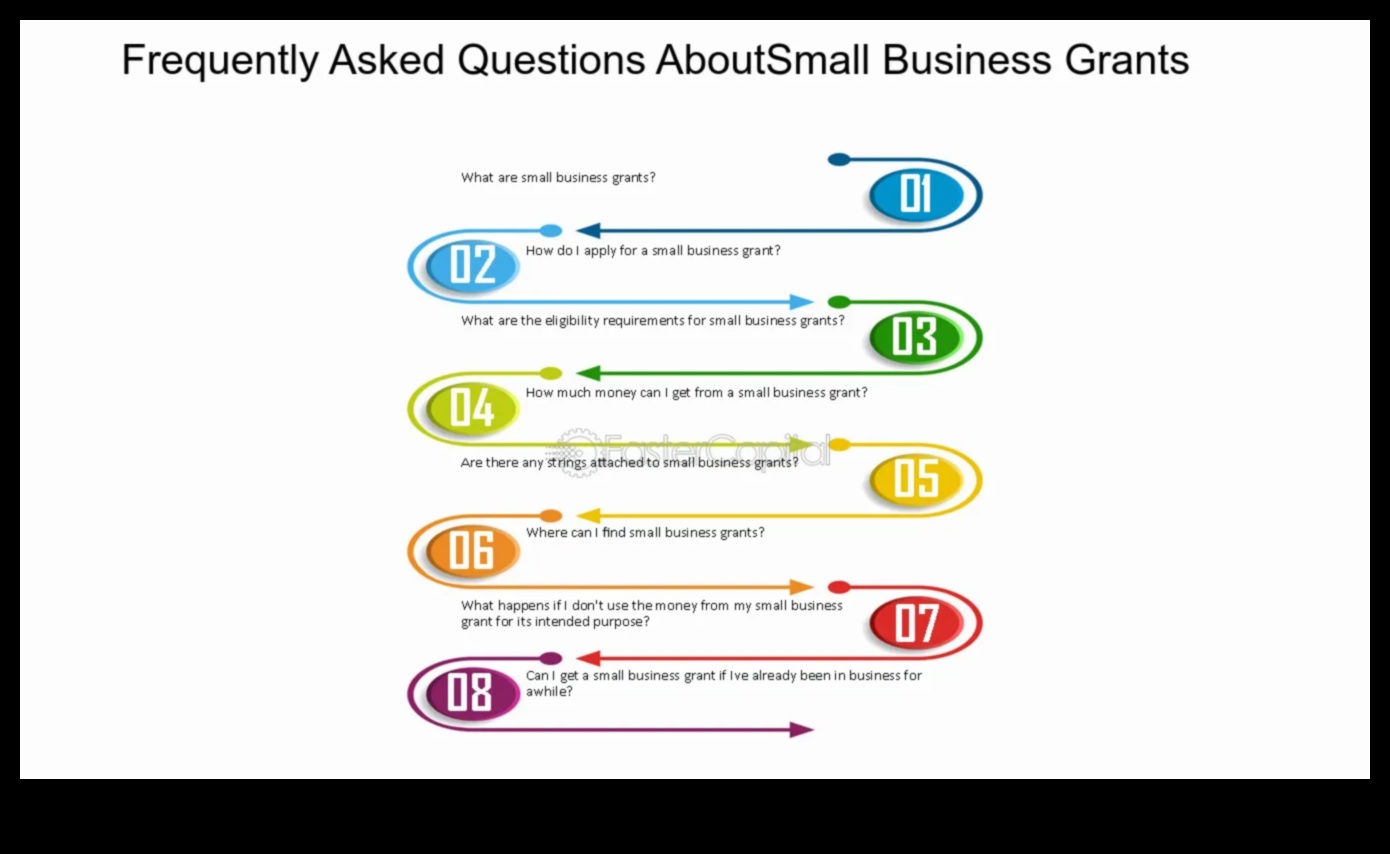

X. FAQ

Q: What is a small business grant?

A: A small business grant is a sum of money awarded to a small business to help it start, expand, or improve its operations. Grants are typically awarded by government agencies or private foundations, and they are often based on a competitive application process.

Q: How do I find small business grants?

A: There are a number of ways to find small business grants. You can start by searching online for government and private grant programs. You can also contact your local chamber of commerce or economic development agency for information about available grants.

Q: What are the eligibility requirements for small business grants?

The eligibility requirements for small business grants vary depending on the program. However, some common requirements include being a small business, being located in a specific geographic area, and having a business plan.