I. Sinking Fund Definition

A sinking fund is a savings account that is used to pay off a debt or to save for a large purchase. The money in the sinking fund is set aside each month and invested so that it can grow over time. When the debt is paid off or the large purchase is made, the sinking fund can be used to cover the cost.

II. Why Use a Sinking Fund?

There are many reasons why you might want to use a sinking fund. Some of the benefits of using a sinking fund include:

- It can help you to save money for a large purchase or goal.

- It can help you to pay off debt more quickly.

- It can give you peace of mind knowing that you have money set aside for unexpected expenses.

III. How to Create a Sinking Fund

To create a sinking fund, you will need to decide what you want to save for and how much you want to save each month. Once you have decided these things, you can open a savings account and start making regular deposits. You can also invest your sinking fund so that it can grow over time.

Types of Sinking Funds

There are many different types of sinking funds that you can create. Some of the most common types include:

- Home repair sinking fund

- Car repair sinking fund

- Vacation sinking fund

- Emergency fund

How Much to Save in a Sinking Fund

The amount of money you should save in a sinking fund will depend on your financial goals and budget. However, a good rule of thumb is to save at least 3-6 months of living expenses. This will help you to cover unexpected expenses and to pay off debt more quickly.

When to Start a Sinking Fund

The best time to start a sinking fund is as soon as possible. This will give you time to save up for your goals and to pay off debt more quickly. Even if you can only save a small amount each month, it will add up over time.

It is important to track your sinking fund so that you can see how much money you are saving each month. You can do this by keeping a written record of your deposits and withdrawals, or by using a budgeting app. Tracking your sinking fund will help you to stay on track and to reach your financial goals.

There are many benefits to using a sinking fund, including:

- It can help you to save money for a large purchase or goal.

- It can help you to pay off debt more quickly.

- It can give you peace of mind knowing that you have money set aside for unexpected expenses.

There are some risks associated with using a sinking fund, including:

- The money in your sinking fund is not accessible for other purposes.

- Your sinking fund could lose value if you invest it.

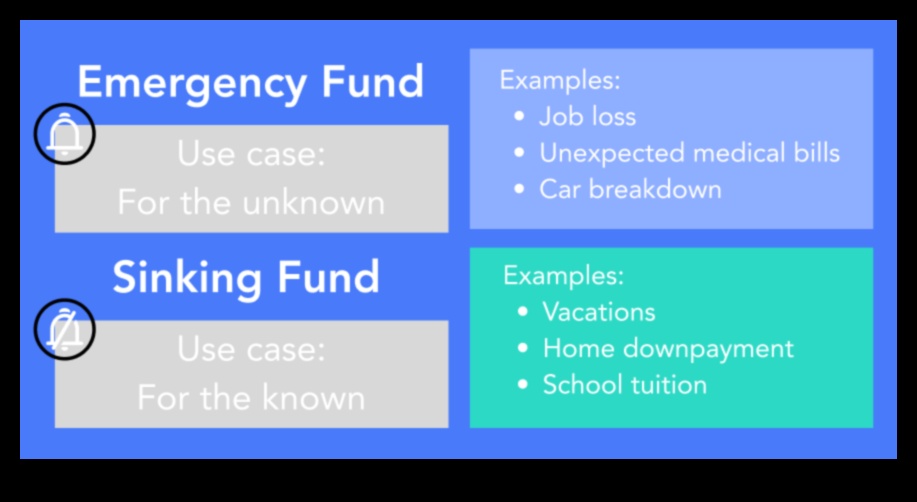

Q: What is the difference between a sinking fund and an emergency fund?

A sinking fund is a savings account that is used to pay off a debt or to save for a large purchase

| Sinking Fund | Reserve Fund |

|---|---|

| Definition | A sinking fund is a savings account that is used to pay off a debt or to save for a large purchase. |

| Why use? | To save for a specific goal, such as a down payment on a house or a new car. |

| How to create? | Set up a separate savings account and make regular deposits into it. |

| Types of sinking funds | There are many different types of sinking funds, including:

|

II. Why Use a Sinking Fund?

There are many reasons why you might want to use a sinking fund. Here are a few of the most common:

- To save for a major purchase

- To pay off debt

- To cover unexpected expenses

- To save for retirement

- To invest for the future

A sinking fund can help you to reach your financial goals by providing you with a dedicated source of money that you can use when you need it. By setting up a sinking fund and making regular contributions, you can be sure that you will have the money you need when the time comes.

III. How to Create a Sinking Fund

Creating a sinking fund is a simple process that can be completed in just a few steps. Here are the steps involved:

- Decide what you want to save for. This could be a major purchase, such as a car or a down payment on a house, or it could be a smaller expense, such as a new roof or a vacation.

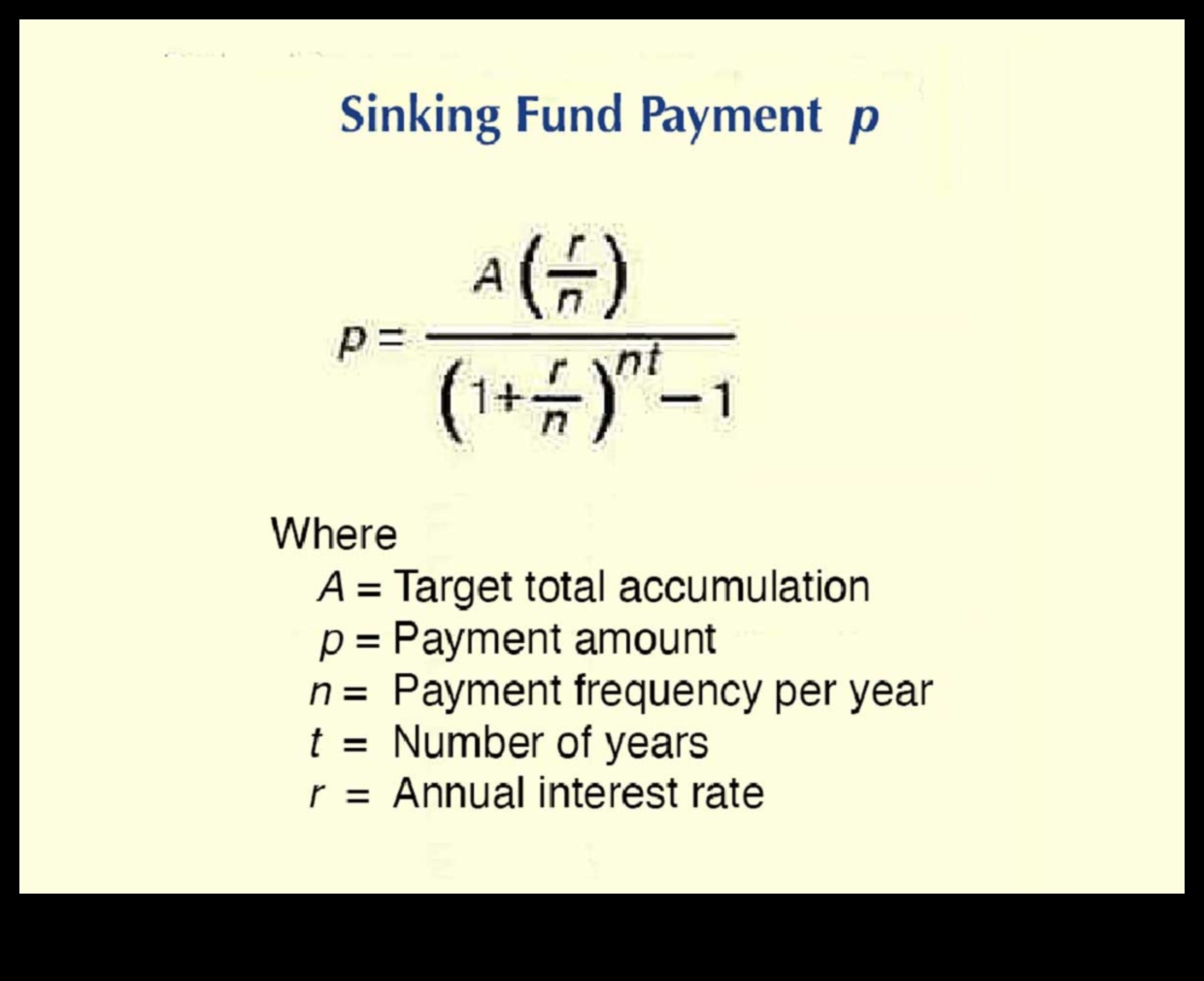

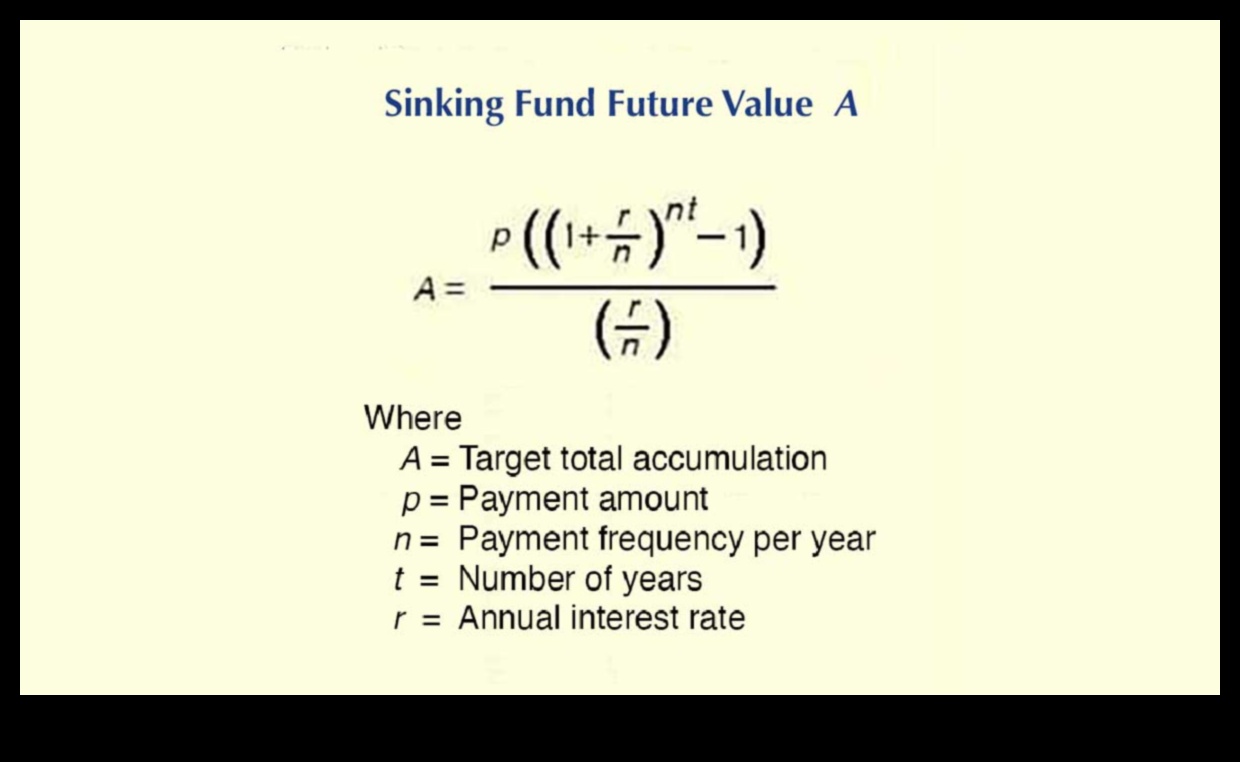

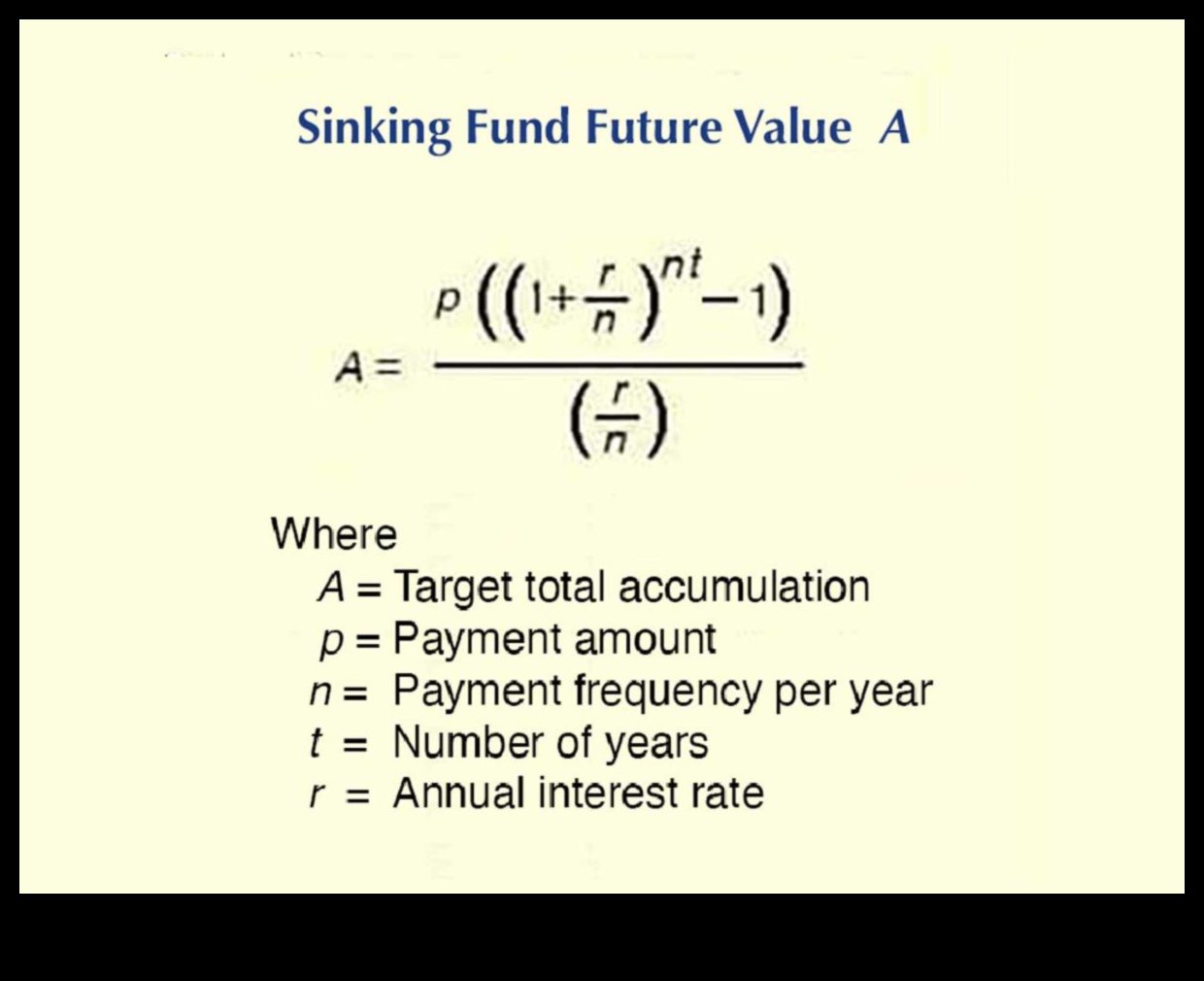

- Calculate how much you need to save. Once you know what you’re saving for, you can calculate how much you need to save each month to reach your goal.

- Set up a sinking fund account. You can set up a sinking fund account at your bank or credit union, or you can use a separate savings account.

- Automate your savings. The easiest way to make sure you’re saving for your goal is to automate your savings. This means setting up a monthly deposit from your checking account to your sinking fund account.

- Track your progress. It’s important to track your progress so you can see how you’re doing and stay motivated. You can do this by keeping a sinking fund spreadsheet or by using a budgeting app.

By following these steps, you can easily create a sinking fund and start saving for your financial goals.

IV. Types of Sinking Funds

There are many different types of sinking funds, each with its own purpose and benefits. Some of the most common types of sinking funds include:

- Emergency funds are used to cover unexpected expenses, such as medical bills or car repairs.

- Retirement funds are used to save for retirement.

- Home improvement funds are used to save for home repairs or renovations.

- Debt repayment funds are used to pay off debt, such as student loans or credit card debt.

- Investment funds are used to invest for the future.

The type of sinking fund you choose will depend on your financial goals and needs.

V. How Much to Save in a Sinking Fund

The amount of money you should save in a sinking fund depends on your financial goals and the type of sinking fund you are creating. For example, if you are saving for a down payment on a house, you will need to save a much larger amount of money than if you are saving for a new car.

Here are some general guidelines for how much to save in a sinking fund:

- For a down payment on a house, you should aim to save at least 20% of the purchase price.

- For a new car, you should aim to save at least 20% of the purchase price.

- For a major home repair, you should aim to save at least 3-6 months of living expenses.

- For an emergency fund, you should aim to save at least 3-6 months of living expenses.

Of course, you may need to save more or less money depending on your individual circumstances. If you are in a high-cost-of-living area, you may need to save more money for a down payment on a house or a new car. If you have a lot of debt, you may need to focus on paying down your debt before you start saving for a sinking fund.

The best way to determine how much to save in a sinking fund is to sit down and make a budget. Once you know your income and expenses, you can start to figure out how much money you can realistically save each month.

What is a Sinking Fund?

A sinking fund is a savings account that is used to pay off a debt or to save for a specific expense. Sinking funds are often used to pay off mortgages, car loans, or other large debts. They can also be used to save for major expenses, such as home repairs or college tuition.

Sinking funds are a great way to save money and to stay on top of your finances. By setting aside money each month, you can ensure that you have the funds available to pay off your debts or to cover unexpected expenses.

Here are some of the benefits of using a sinking fund:

- You can save money for a specific goal.

- You can stay on top of your finances.

- You can avoid debt.

- You can make your finances more flexible.

If you are thinking about starting a sinking fund, there are a few things you need to consider. First, you need to decide what you want to save for. Once you know your goal, you can start to set aside money each month. You should also make sure that you have a plan for how you will use the money in your sinking fund.

Sinking funds are a great way to save money and to reach your financial goals. By setting aside money each month, you can ensure that you have the funds available to pay off your debts or to cover unexpected expenses.

VII. How to Track Your Sinking Fund

There are a few different ways to track your sinking fund. You can use a spreadsheet, a budgeting app, or a dedicated sinking fund app.

If you’re using a spreadsheet, you can create a new sheet and set up a table with the following columns:

- Date

- Deposit

- Withdrawal

- Current Balance

Each time you make a deposit or withdrawal, you can update the corresponding column in the table. This will allow you to track your sinking fund’s progress over time.

If you’re using a budgeting app, you can usually create a sinking fund category. This will allow you to track your sinking fund’s progress alongside your other financial goals.

If you’re using a dedicated sinking fund app, the app will typically track your sinking fund’s progress for you. This can be a great option if you’re not comfortable tracking your sinking fund yourself.

No matter which method you choose, it’s important to track your sinking fund so that you can make sure it’s on track to reach your goal.

Benefits of Using a Sinking Fund

There are many benefits to using a sinking fund, including:

- It can help you save for large purchases or expenses.

- It can help you avoid debt.

- It can give you peace of mind knowing that you have money set aside for unexpected expenses.

- It can help you reach your financial goals faster.

If you are looking for a way to save money and improve your financial health, a sinking fund is a great option. It is a simple and effective way to set aside money for future expenses, and it can help you achieve your financial goals.

IX. Risks of Using a Sinking Fund

There are a few risks associated with using a sinking fund, including:

- The risk that you will not be able to save enough money in the sinking fund to cover the expense.

- The risk that the value of the investments in the sinking fund will decrease, which could reduce the amount of money available to cover the expense.

- The risk that you will forget about the sinking fund and not use the money for its intended purpose.

It is important to be aware of these risks before you decide to use a sinking fund. By understanding the risks, you can take steps to mitigate them and ensure that you are using a sinking fund in a way that is most beneficial for you.

FAQ

Q: What is a sinking fund?

A: A sinking fund is a savings account that is used to pay off a debt or to replace a major asset.

Q: Why use a sinking fund?

A: There are many reasons to use a sinking fund, including:

- To save for a down payment on a house

- To pay off a car loan

- To replace a roof

- To cover unexpected expenses

Q: How to create a sinking fund?

A: To create a sinking fund, you will need to:

- Decide how much you want to save each month

- Open a savings account specifically for your sinking fund

- Automate your savings so that you contribute to your sinking fund each month