I. Introduction

II. Differences Between Student Loans and Scholarships

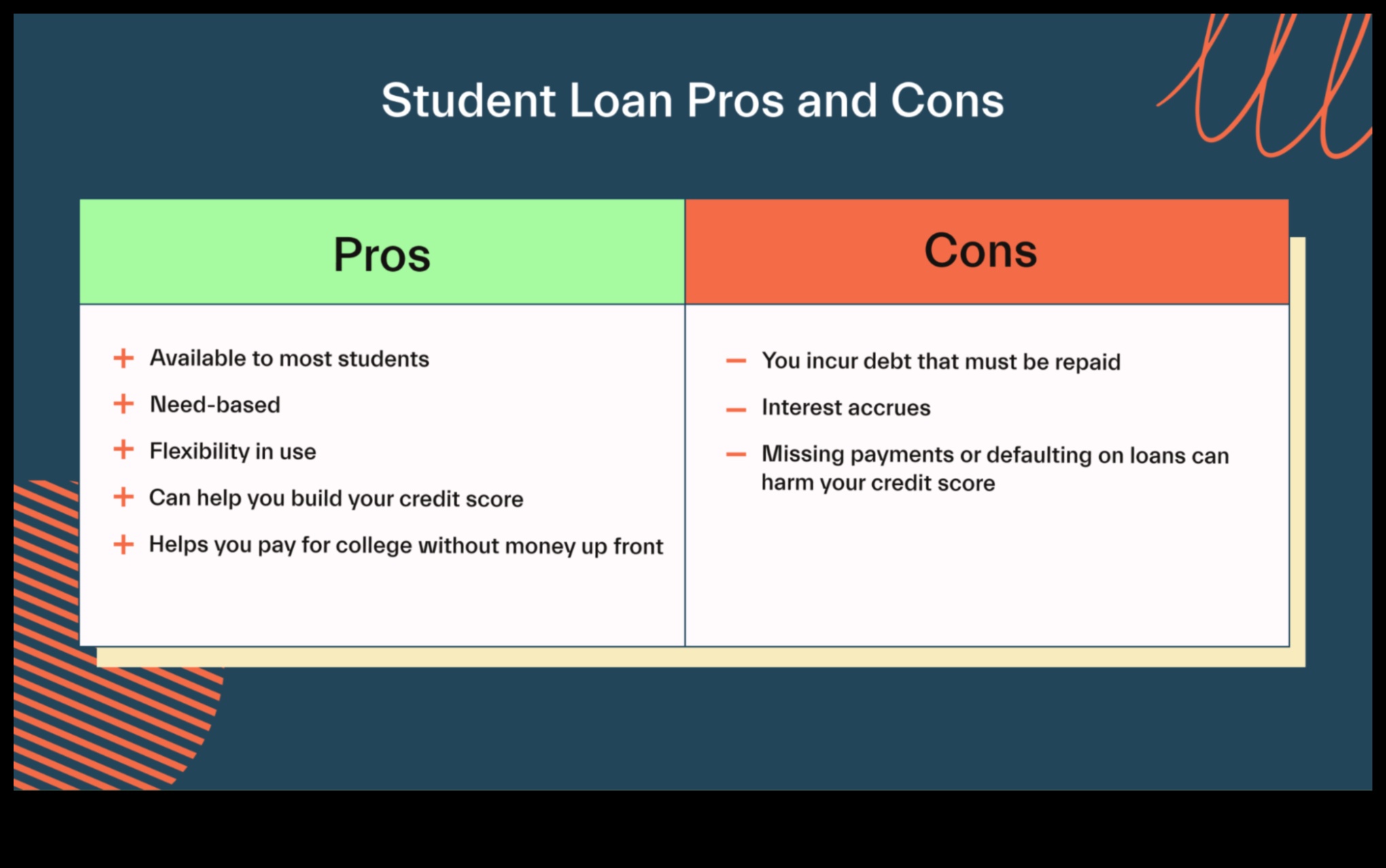

III. Benefits of Student Loans

IV. Benefits of Scholarships

V. How to Apply for Student Loans

VI. How to Apply for Scholarships

VII. Which is Better: Student Loans or Scholarships?

VIII. Conclusion

IX. FAQ

X. Resources

| Feature | Student Loan | Scholarship |

|---|---|---|

| Cost | Must be repaid with interest | No repayment required |

| Eligibility | Must meet credit and income requirements | Based on academic merit or financial need |

| Amount | Can borrow up to the cost of attendance | Limited to a specific amount |

| Repayment | Repayments begin after graduation | No repayment required |

| Advantages | Can cover the full cost of attendance | No repayment required |

| Disadvantages | Must be repaid with interest | May have limited availability |

II. Differences Between Student Loans and Scholarships

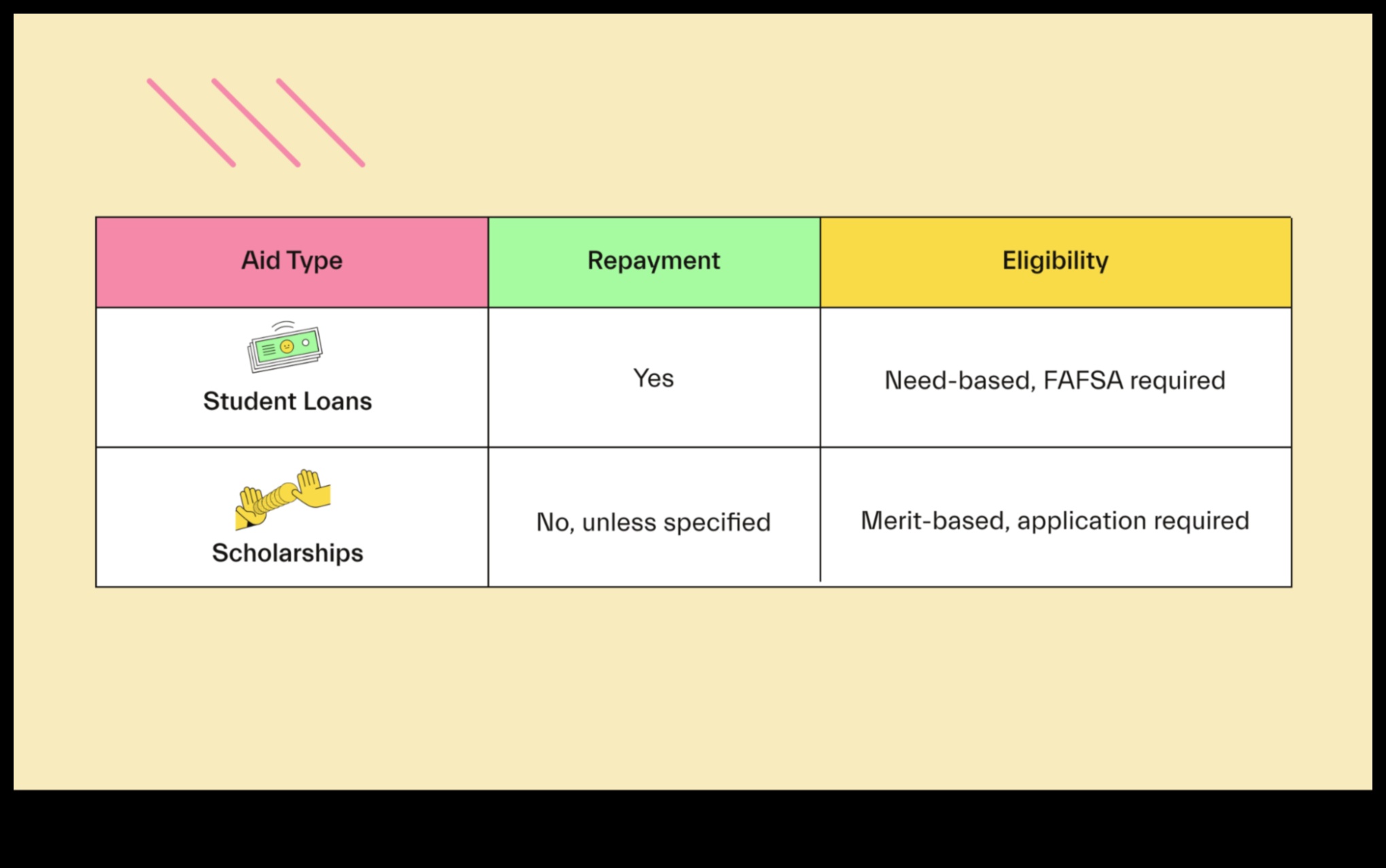

Student loans and scholarships are two of the most common forms of financial aid available to college students. While both types of aid can help you pay for college, there are some key differences between them.

- Student loans are borrowed money that must be repaid with interest. Scholarships, on the other hand, are free money that does not have to be repaid.

- Student loans are available to students of all financial backgrounds. Scholarships are often awarded based on academic merit, financial need, or a combination of the two.

- Student loans are typically repaid over a period of years after graduation. Scholarships do not have to be repaid.

- Student loans can be a source of financial stress for borrowers. Scholarships can help students avoid the burden of student loan debt.

It is important to understand the differences between student loans and scholarships before you decide which type of aid is right for you. If you are eligible for a scholarship, it is generally a better option than taking out a student loan. Scholarships can help you save money on your college education and avoid the burden of student loan debt.

II. Differences Between Student Loans and Scholarships

Student loans and scholarships are two of the most common forms of financial aid available to college students. While both can help you pay for college, there are some key differences between the two.

Student loans are borrowed money that must be repaid with interest. Scholarships, on the other hand, are free money that does not have to be repaid.

Student loans are available from a variety of sources, including the federal government, private lenders, and colleges and universities. Scholarships, on the other hand, are typically awarded by organizations or individuals.

Student loans have a fixed interest rate, which means that the amount of interest you pay will not change over time. Scholarships, on the other hand, may have a variable interest rate, which means that the amount of interest you pay could change over time.

Student loans must be repaid over a period of time, typically 10 to 20 years. Scholarships, on the other hand, do not have to be repaid.

Student loans can have a negative impact on your credit score, while scholarships do not.

Ultimately, the best way to decide which type of financial aid is right for you is to weigh the pros and cons of each option. If you are considering taking out a student loan, be sure to do your research and compare different lenders to find the best interest rate and terms.

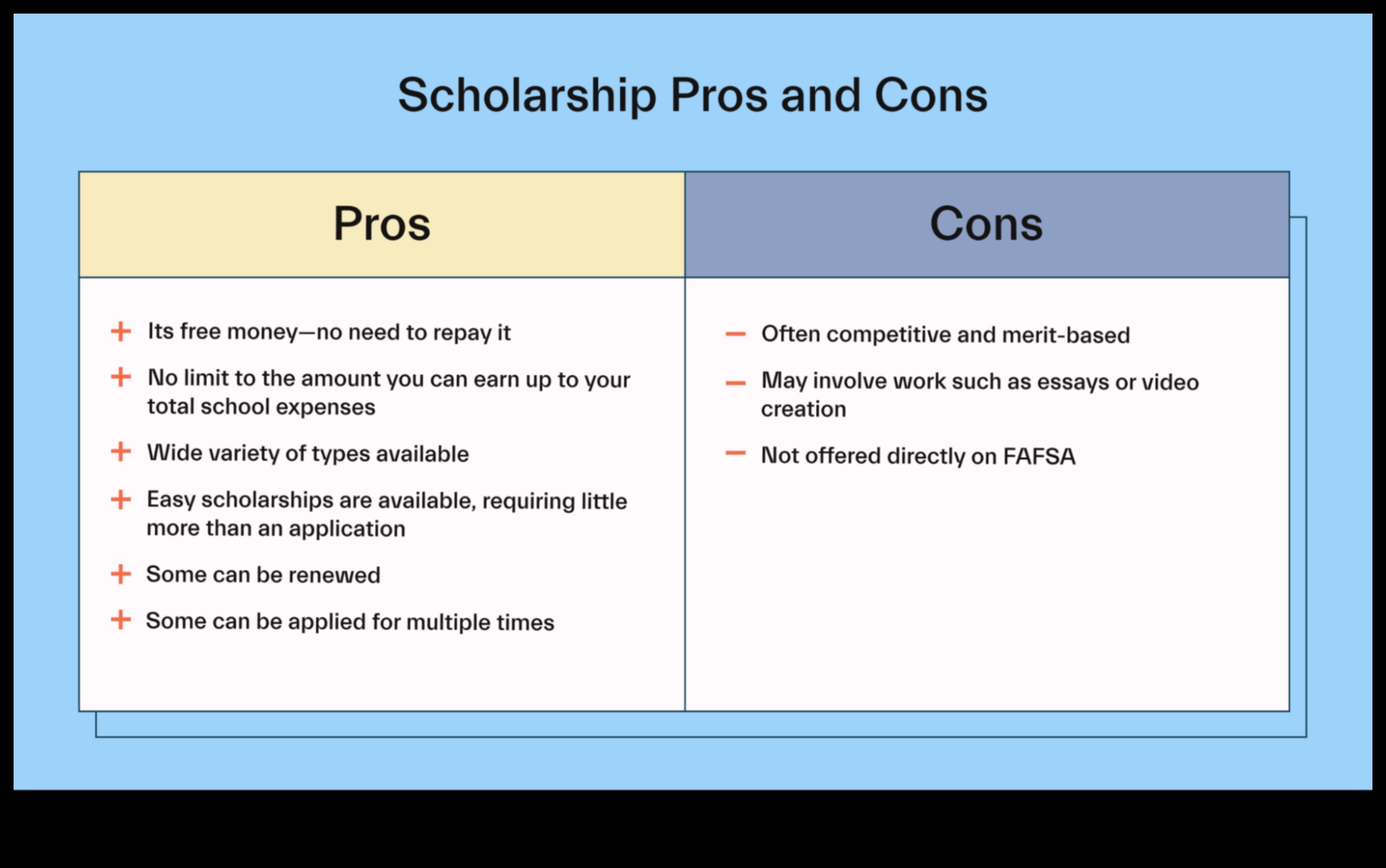

IV. Benefits of Scholarships

Scholarships can provide a number of benefits to students, including:

- Financial assistance

- Improved academic standing

- Increased motivation

- Networking opportunities

- A sense of accomplishment

Financial assistance

Scholarships can provide a significant amount of financial assistance to students, helping them to cover the cost of tuition, fees, books, and living expenses. This can be a major help for students who are struggling to pay for college, and it can allow them to focus on their studies without having to worry about money.

Improved academic standing

Scholarships can help students to improve their academic standing. When students know that they are eligible for a scholarship, they are more likely to study hard and earn good grades. This can lead to a higher GPA, which can make a student more competitive for admission to college or university, and it can also lead to more scholarship opportunities.

Increased motivation

Scholarships can help to motivate students to achieve their academic goals. When students know that they are eligible for a scholarship, they are more likely to set high goals for themselves and to work hard to achieve them. This can lead to a more positive attitude towards learning, and it can also help students to develop a strong work ethic.

Networking opportunities

Scholarships can provide students with networking opportunities that can help them to get ahead in their careers. When students meet with scholarship donors and other scholarship recipients, they have the opportunity to build relationships that can be beneficial in the future. These relationships can help students to find jobs, internships, and other opportunities after college.

A sense of accomplishment

Scholarships can give students a sense of accomplishment. When students earn a scholarship, they know that they have achieved something special. This can boost their self-confidence and motivation, and it can also help them to set even higher goals for themselves in the future.

II. Differences Between Student Loans and Scholarships

Student loans and scholarships are two of the most common types of financial aid available to college students. While both can help you pay for college, there are some key differences between the two.

Student loans are borrowed money that must be repaid with interest. The interest rate on student loans is typically higher than the interest rate on other types of loans, such as personal loans or car loans. Student loans are also typically repaid over a longer period of time, which can make them more expensive in the long run.

Scholarships, on the other hand, are free money that does not have to be repaid. Scholarships are awarded based on a variety of criteria, such as academic merit, financial need, or extracurricular activities. Scholarships can be renewable, meaning that you can receive them for multiple years, or they can be one-time awards.

Here is a table that summarizes the key differences between student loans and scholarships:

| Feature | Student Loans | Scholarships |

|---|---|---|

| Cost | Must be repaid with interest | Free money |

| Interest rate | Typically higher than other types of loans | Typically no interest |

| Repayment period | Typically repaid over a long period of time | May be renewable or one-time awards |

It is important to understand the key differences between student loans and scholarships before you decide which type of financial aid is right for you. If you are considering taking out student loans, be sure to compare interest rates and repayment terms from different lenders. You should also make sure that you are eligible for any scholarships that you are interested in.

II. Differences Between Student Loans and Scholarships

Student loans and scholarships are two of the most common forms of financial aid for college students. However, there are some key differences between the two types of aid.

Student loans are borrowed money that must be repaid with interest. The interest rate on student loans is typically higher than the interest rate on other types of loans, such as personal loans or car loans. Student loans are also typically repaid over a longer period of time, which can make them more difficult to afford.

Scholarships, on the other hand, are free money that does not have to be repaid. Scholarships are awarded based on academic merit, financial need, or other criteria. Scholarships are often renewable, which means that they can be renewed for multiple years of college.

In general, scholarships are a better option than student loans for college students. Scholarships do not have to be repaid, and they can help students save money on the cost of college. However, student loans can be a good option for students who do not qualify for scholarships or who need additional financial assistance.

VII. Which is Better: Student Loans or Scholarships?

There is no one-size-fits-all answer to the question of whether student loans or scholarships are better. The best option for you will depend on your individual financial situation and needs.

Here are some factors to consider when making your decision:

- Your financial need. If you are eligible for a scholarship, it can be a great way to cover your college costs without having to take on debt. However, if you do not qualify for a scholarship, student loans may be your only option.

- Your credit score. If you have a good credit score, you may be able to get a student loan with a low interest rate. This can save you money in the long run. However, if you have a poor credit score, you may have to pay a higher interest rate on your student loans.

- Your repayment plans. Student loans come with a variety of repayment plans, so you can choose one that fits your budget and financial goals. Scholarships, on the other hand, do not have to be repaid.

Ultimately, the decision of whether to take out student loans or apply for scholarships is a personal one. You should weigh the pros and cons of each option carefully before making a decision.

Conclusion

Student loans and scholarships are two important sources of financial aid for college students. Each type of financial aid has its own advantages and disadvantages, and the best option for you will depend on your individual circumstances. It is important to do your research and compare your options before making a decision.

If you have any questions about student loans or scholarships, be sure to talk to your financial aid advisor. They can help you understand your options and make the best decision for your financial situation.

IX. FAQ

Q: What is the difference between a student loan and a scholarship?

A: A student loan is a type of debt that is borrowed from a financial institution, such as a bank or credit union. The borrower is responsible for repaying the loan, plus interest, over a period of time. A scholarship is a type of financial aid that is awarded to students based on their academic achievements or financial need. Scholarships do not have to be repaid.

Q: Which is better: a student loan or a scholarship?

The answer to this question depends on your individual circumstances. If you have a good credit score and are able to afford the monthly payments, a student loan may be a good option for you. If you are struggling financially, a scholarship may be a better option.

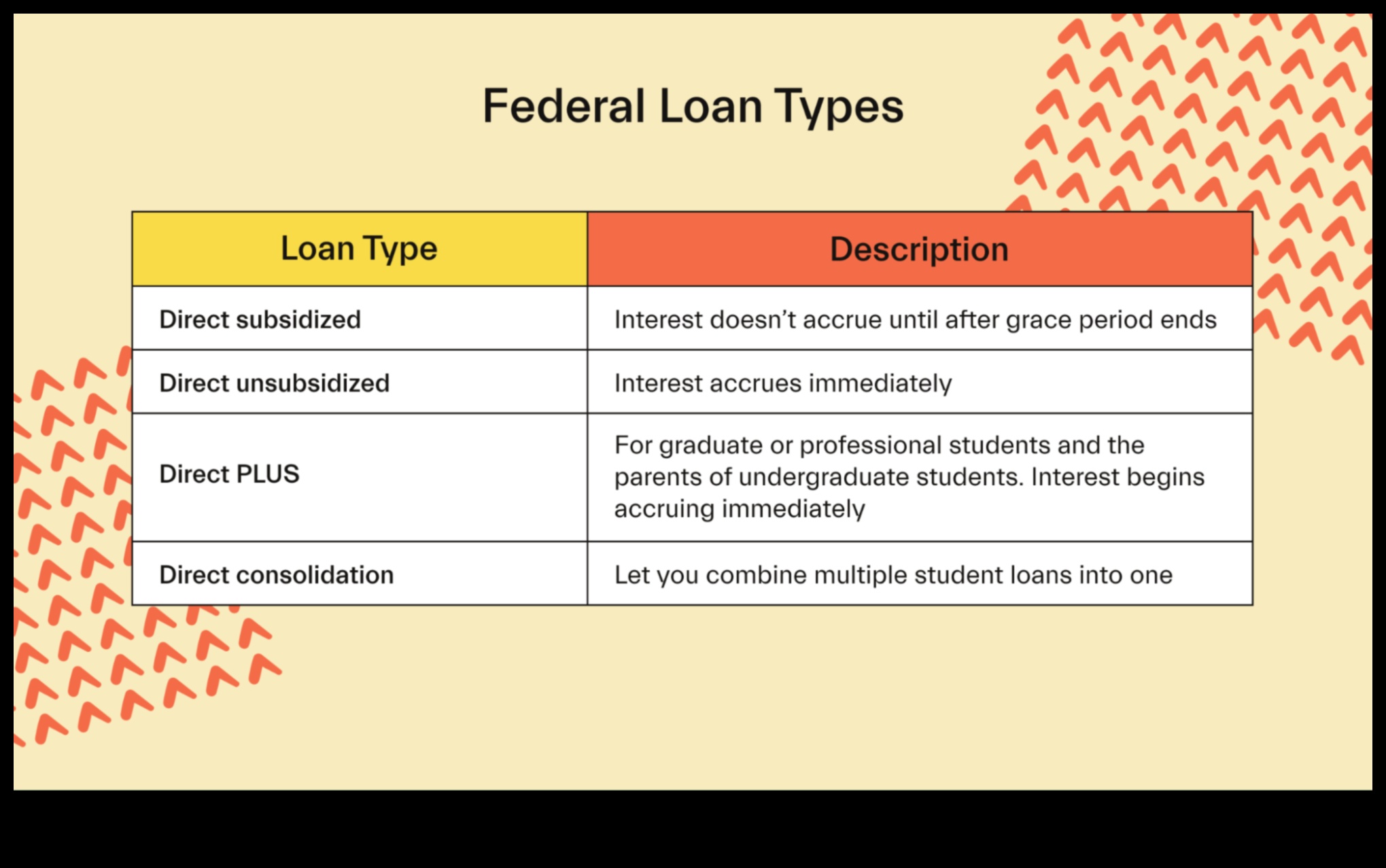

Q: How do I apply for a student loan?

You can apply for a student loan through the federal government or through a private lender. To apply for a federal student loan, you will need to fill out the Free Application for Federal Student Aid (FAFSA). To apply for a private student loan, you will need to contact a private lender directly.

Q: How do I apply for a scholarship?

There are many different ways to apply for scholarships. You can search for scholarships online, through your school, or through community organizations. When you apply for a scholarship, you will need to submit an application form and any other required materials.

Q: What are the benefits of a student loan?

The benefits of a student loan include:

- You can borrow money to pay for school expenses, such as tuition, fees, books, and living expenses.

- The interest rates on student loans are generally lower than the interest rates on other types of loans.

- Student loans can be deferred or forgiven if you meet certain criteria.

Q: What are the drawbacks of a student loan?

The drawbacks of a student loan include:

- You have to repay the loan, plus interest, over a period of time.

- The monthly payments on a student loan can be high, especially if you have a large loan balance.

- If you default on your student loans, it can damage your credit score.

Q: What are the benefits of a scholarship?

The benefits of a scholarship include:

- You don’t have to repay a scholarship.

- Scholarships can help you pay for school expenses, such as tuition, fees, books, and living expenses.

- Scholarships can help you improve your financial situation after college.

Q: What are the drawbacks of a scholarship?

The drawbacks of a scholarship include:

- Scholarships are often competitive and difficult to win.

- Scholarships may have specific requirements, such as a minimum GPA or a certain major.

- Scholarships may only be available for a certain period of time.

How is a student loan different from a scholarship?

Student loans and scholarships are both forms of financial aid that can help students pay for college. However, there are some key differences between the two.

Student loans are borrowed money that must be repaid with interest. Scholarships, on the other hand, are free money that does not have to be repaid.

Student loans are available from a variety of sources, including the federal government, private lenders, and colleges and universities. Scholarships, on the other hand, are typically awarded by organizations or individuals.

Student loans are usually based on financial need, while scholarships may be based on academic merit, extracurricular activities, or other factors.

Student loans must be repaid over time, typically with monthly payments. Scholarships do not have to be repaid.

Student loans can have a negative impact on your credit score, while scholarships do not.

Student loans can be a good option for students who need to borrow money to pay for college, but it is important to understand the terms of the loan before you borrow. Scholarships are a great way to get free money for college, but it is important to apply for scholarships early and to research the different scholarships that are available.

FAQ

Q: What are the benefits of student loans?

A: Student loans can help students pay for college expenses, such as tuition, fees, books, and living expenses. Student loans can also help students build credit.

Q: What are the drawbacks of student loans?

A: Student loans must be repaid with interest, which can add up over time. Student loans can also have a negative impact on your credit score.

Q: What are the benefits of scholarships?

A: Scholarships are free money that can help students pay for college expenses. Scholarships can also help students build their resumes and distinguish themselves from other applicants.

Q: What are the drawbacks of scholarships?

A: Scholarships are often competitive, and there is no guarantee that you will receive one. Scholarships may also have specific requirements, such as GPA or extracurricular activities.