Slush Funds

I. Slush Funds Definition

II. History of Slush Funds

III. Types of Slush Funds

IV. Why Companies Use Slush Funds

V. The Dangers of Slush Funds

VI. How to Detect Slush Funds

VII. How to Prevent Slush Funds

VIII. Consequences of Slush Funds

IX. Slush Funds in the News

X. FAQ

1. slush fund

2. secret fund

3. off-the-books fund

4. discretionary fund

5. corruption

People searching for “what are slush funds” are likely trying to understand what slush funds are and how they work. They may also be looking for information on the legal implications of slush funds, or for advice on how to create or use a slush fund.

To answer this question, we need to understand what a slush fund is. A slush fund is a pool of money that is kept separate from the main accounts of a company or organization. It is often used for discretionary expenses, such as bribes, political donations, or other illegal or unethical purposes.

People who are searching for “what are slush funds” are likely trying to understand what these funds are and how they are used. They may also be looking for information on the legal implications of slush funds, or for advice on how to create or use a slush fund.

| Feature | Definition |

|---|---|

| Slush Fund | A pool of money that is kept separate from the main accounts of a company or organization. |

| Secret Fund | A fund that is not disclosed to the public or to the company’s shareholders. |

| Off-the-Books Fund | A fund that is not recorded in the company’s official financial records. |

| Discretionary Fund | A fund that can be used for any purpose at the discretion of the person who controls it. |

| Corruption | The use of a slush fund for illegal or unethical purposes, such as bribes, political donations, or other forms of fraud. |

II. History of Slush Funds

Slush funds have been around for centuries. In the early 1900s, they were used by political bosses to bribe voters and elected officials. In the 1950s, they were used by corporations to pay for illegal activities, such as bribing foreign officials. In the 1970s, they were used by the Watergate scandal to pay for illegal campaign activities.

Today, slush funds are still used by corporations, politicians, and other organizations for a variety of illegal or unethical purposes. However, the legal implications of slush funds have become more serious in recent years. In the United States, the Sarbanes-Oxley Act of 2002 made it illegal for companies to use slush funds to hide illegal activities.

In other countries, the laws against slush funds vary. However, in general, slush funds are considered to be illegal and unethical.

III. Types of Slush Funds

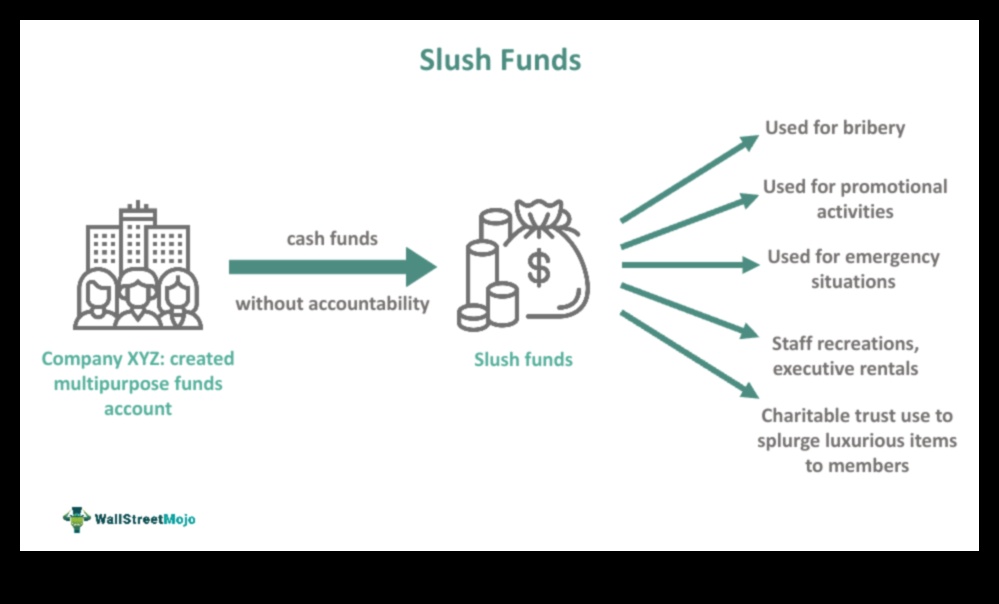

There are many different types of slush funds, each with its own unique purpose. Some of the most common types of slush funds include:

- Bribery funds

- Political donations funds

- Personal expenses funds

- Fraudulent expense reimbursement funds

- Tax evasion funds

Each of these types of slush funds is used for a different purpose, and each has its own set of risks and consequences. It is important to be aware of the different types of slush funds and the risks associated with them in order to protect yourself from being involved in any illegal or unethical activity.

IV. Why Companies Use Slush Funds

There are a number of reasons why companies use slush funds. Some of the most common reasons include:

To pay for bribes or other illegal or unethical activities. Slush funds can be used to pay for bribes to government officials, regulators, or other third parties. This can help companies to win contracts, avoid regulations, or otherwise gain an unfair advantage.

To pay for political donations. Slush funds can be used to make political donations that are not publicly disclosed. This can help companies to influence politicians and government policy.

To cover up financial losses. Slush funds can be used to hide financial losses from investors or regulators. This can help companies to maintain their stock price or avoid regulatory scrutiny.

To pay for personal expenses. Slush funds can be used to pay for personal expenses for executives or other employees. This can include things like travel, entertainment, or gifts.

Slush funds can be a major problem for companies. They can lead to corruption, financial losses, and regulatory scrutiny. Companies should take steps to prevent the use of slush funds, and regulators should crack down on companies that use them.

V. The Dangers of Slush Funds

Slush funds can be a dangerous way for companies to operate. They can be used to hide illegal or unethical activities, and they can also be used to circumvent regulations and laws. In some cases, slush funds have been used to fund terrorism or other criminal activities.

There are a number of dangers associated with slush funds, including:

- Corruption. Slush funds can be used to bribe government officials or other influential people. This can lead to unfair advantages for the company, and it can also undermine the integrity of the government.

- Financial fraud. Slush funds can be used to hide financial transactions that would otherwise be illegal or unethical. This can lead to financial losses for investors and other stakeholders.

- Tax evasion. Slush funds can be used to evade taxes. This can cost the government revenue, and it can also put other taxpayers at a disadvantage.

- Damage to reputation. Slush funds can damage a company’s reputation. If it is discovered that a company is using slush funds, it can lose customers, investors, and employees.

Slush funds are a serious problem that can have a number of negative consequences. It is important for companies to be aware of the dangers of slush funds and to take steps to prevent them from being used.

VI. How to Detect Slush Funds

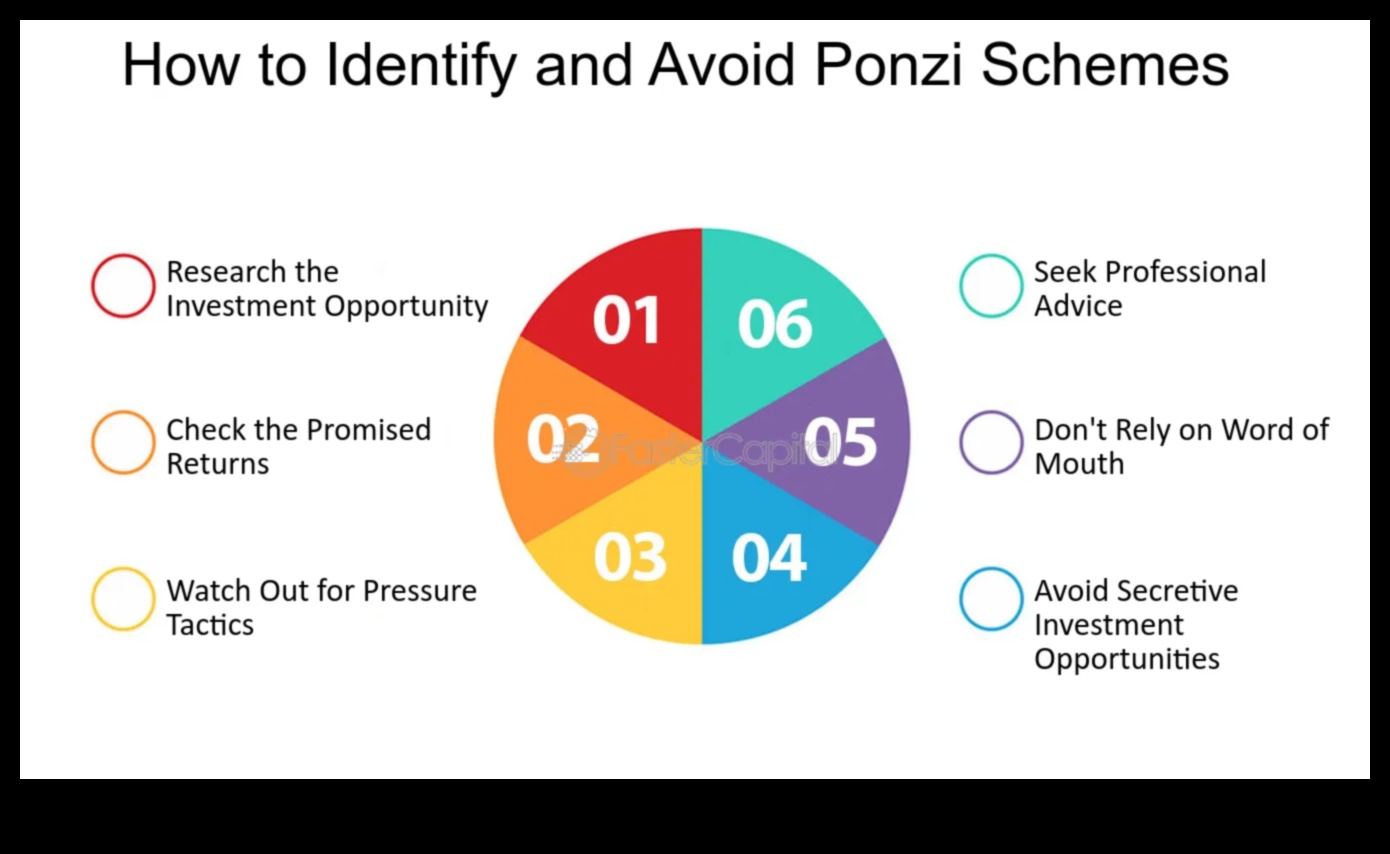

There are a number of ways to detect slush funds. Some of the most common methods include:

- Examining financial records. Slush funds are often kept separate from the main accounts of a company or organization, so it is important to examine all financial records carefully to identify any suspicious transactions.

- Monitoring employee behavior. Employees who are involved in slush funds may exhibit suspicious behavior, such as spending large amounts of money on personal expenses, or making frequent trips to casinos or other high-risk businesses.

- Conducting internal investigations. If there is reason to believe that a slush fund exists, it is important to conduct an internal investigation to gather evidence and identify the individuals involved.

Slush funds can be difficult to detect, but by following these tips, you can increase your chances of identifying them.

VII. How to Prevent Slush Funds

There are a number of steps that companies can take to prevent the creation and use of slush funds. These include:

- Establishing clear policies and procedures for all financial transactions.

- Implementing strong internal controls, such as separation of duties and segregation of duties.

- Ensuring that all employees are aware of the company’s policies and procedures on slush funds.

- Conducting regular audits of all financial transactions.

- Encouraging employees to report any suspected slush funds.

By taking these steps, companies can help to reduce the risk of slush funds being created and used.

Consequences of Slush Funds

Slush funds can have a number of negative consequences, including:

- Corruption

- Financial mismanagement

- Tax evasion

- Legal liability

- Damage to reputation

Corruption is a major problem that can be caused by slush funds. When money is used for bribes or other illegal purposes, it can lead to a breakdown in trust and transparency. This can damage the reputation of a company or organization and make it difficult to attract investors or customers.

Financial mismanagement is another problem that can be caused by slush funds. When money is not properly accounted for, it can be difficult to track how it is being used. This can lead to waste and inefficiency, and it can also make it difficult to detect fraud.

Tax evasion is a serious crime that can be committed by companies that use slush funds. When money is kept off the books, it can be difficult for the government to collect taxes on it. This can lead to a loss of revenue for the government and it can also make it difficult to fund public programs.

Legal liability is another potential consequence of slush funds. When money is used for illegal or unethical purposes, it can expose a company or organization to legal risks. This can include fines, lawsuits, and even criminal prosecution.

Slush funds can also damage the reputation of a company or organization. When it is discovered that a company is using slush funds, it can damage the public’s trust in that company. This can make it difficult to attract investors or customers, and it can also lead to a loss of market share.

Slush funds have been in the news in recent years due to a number of high-profile scandals. In 2016, for example, it was revealed that the Trump Organization had used a slush fund to pay hush money to women who had accused Donald Trump of sexual assault. In 2017, it was revealed that the British Prime Minister, David Cameron, had used a slush fund to pay for renovations to his Downing Street flat. And in 2018, it was revealed that the President of South Korea, Park Geun-hye, had used a slush fund to bribe lawmakers and influence elections.

These scandals have highlighted the fact that slush funds can be used for a variety of illegal or unethical purposes. They can be used to bribe officials, influence elections, and cover up wrongdoing. As a result, slush funds have become a major concern for law enforcement and regulators around the world.

X. FAQ

1. What is a slush fund?

2. What are the dangers of slush funds?

3. How can I prevent slush funds from being used in my company?