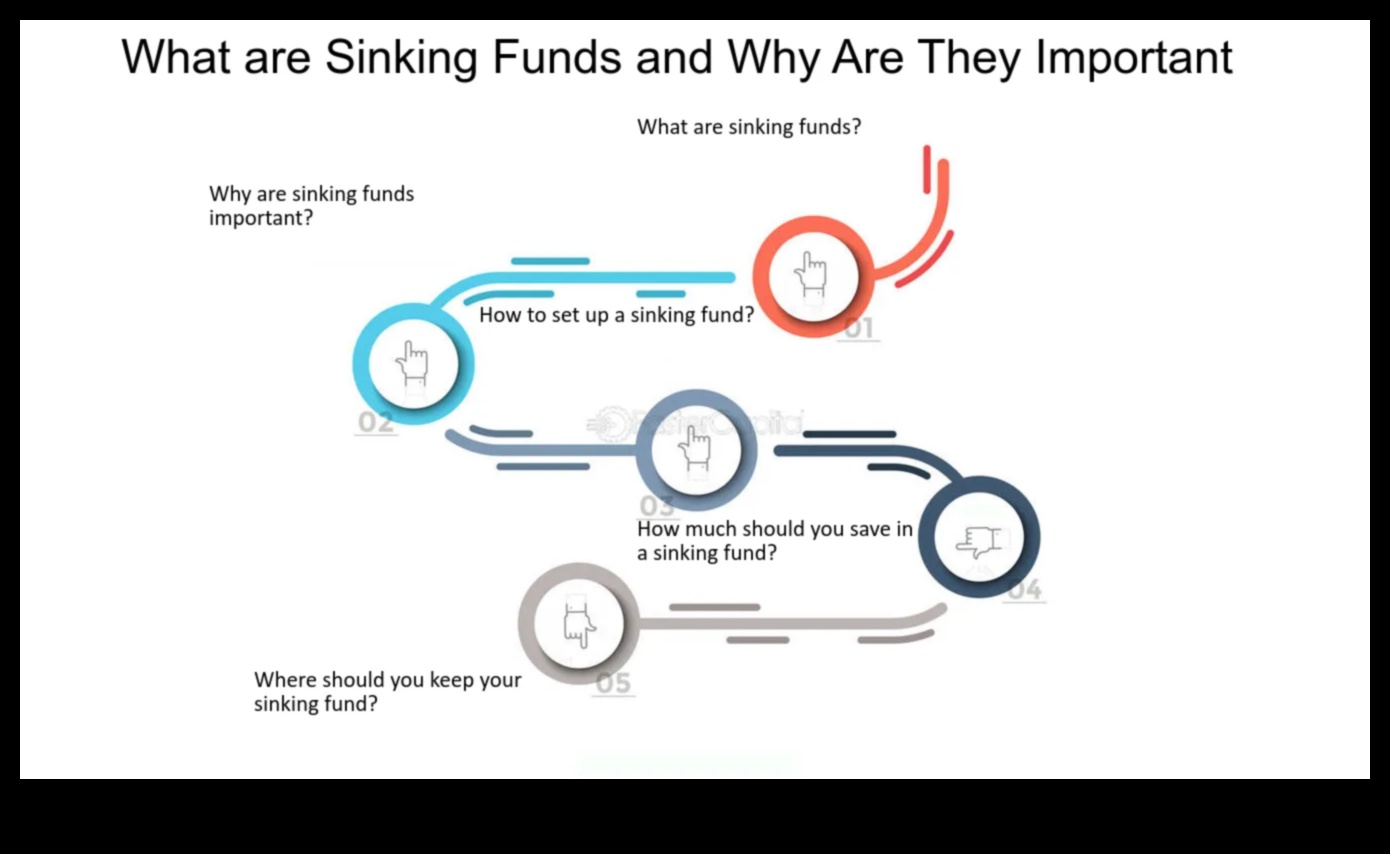

I. What is a sinking fund?

A sinking fund is a savings account that you set aside specifically to pay for a large, future expense. This could be anything from a down payment on a house to a new car to a major home repair. By setting aside money each month, you can gradually build up a reserve that will help you cover the cost of these expenses when they arise.

II. Why do you need a sinking fund?

There are a few reasons why you might want to consider creating a sinking fund.

To save for a large, future expense. This is the most common reason for creating a sinking fund. By setting aside money each month, you can gradually build up a reserve that will help you cover the cost of a major purchase or expense.

To reduce your monthly expenses. If you know that you have a large expense coming up, you can start saving for it now. This will help you avoid having to take on debt or dipping into your emergency fund.

To improve your financial security. Having a sinking fund can give you peace of mind knowing that you have the money to cover unexpected expenses. This can help you sleep better at night and reduce your stress levels.

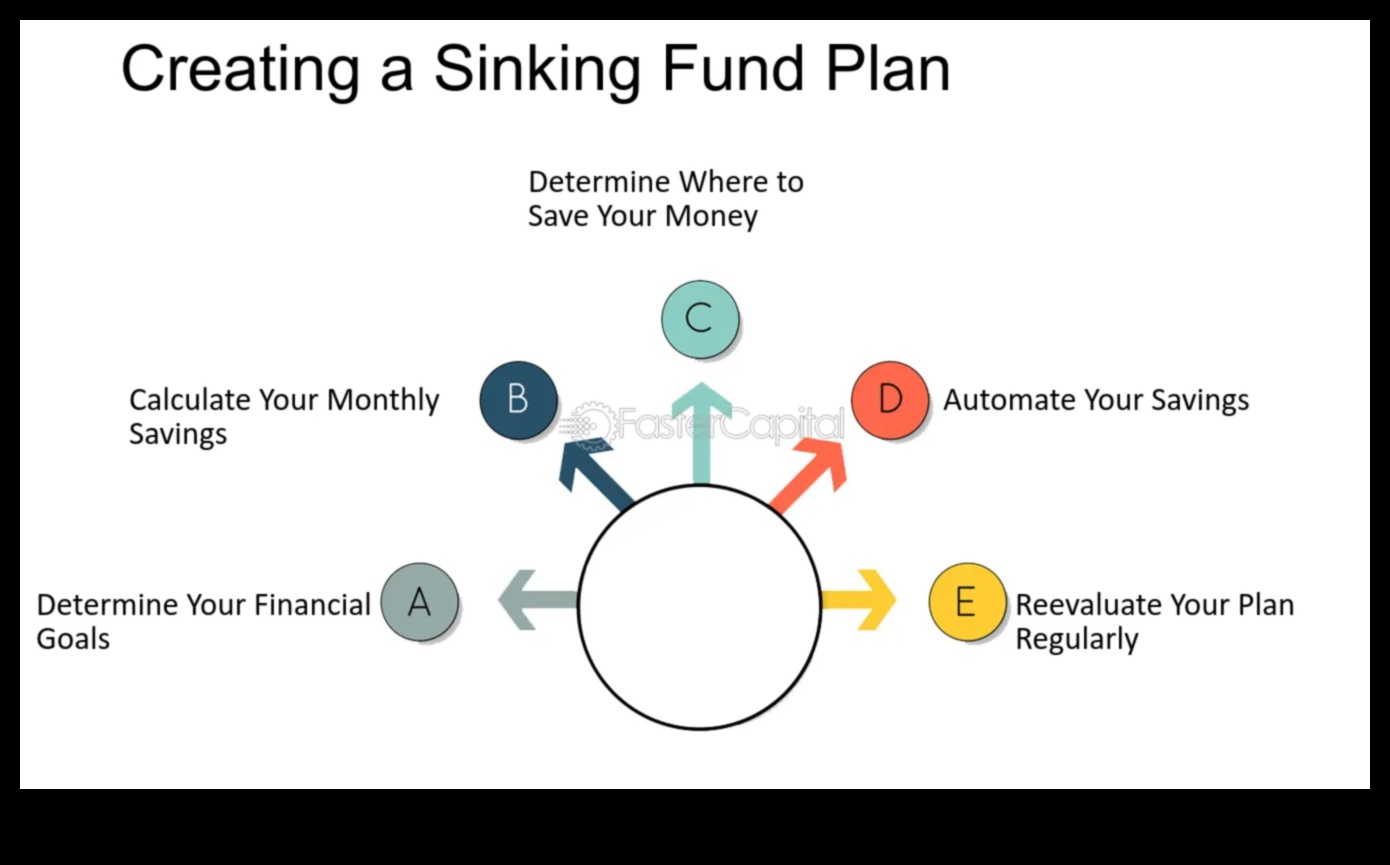

III. How to create a sinking fund?

Creating a sinking fund is easy. Here are a few steps to get you started:

1. Decide what you want to save for. This could be anything from a down payment on a house to a new car to a major home repair.

2. Estimate how much you need to save. Once you know what you want to save for, you need to estimate how much money you need to set aside each month.

3. Set up a savings account. You will need to set up a savings account where you can deposit the money you are saving for your sinking fund.

4. Automate your savings. The easiest way to save money for a sinking fund is to automate your savings. This means setting up a system where a certain amount of money is automatically transferred from your checking account to your savings account each month.

5. Track your progress. It is important to track your progress so that you can see how close you are to reaching your goal.

IV. How much money should you put in a sinking fund?

The amount of money you should put in a sinking fund depends on your financial situation and your goals. A good rule of thumb is to save three to six months of living expenses. This will help you cover unexpected expenses and give you peace of mind.

V. Where to keep your sinking fund?

You can keep your sinking fund in any type of savings account. However, it is important to choose an account that is safe and secure. Some good options include:

A high-yield savings account. This type of account typically offers higher interest rates than a traditional savings account.

A certificate of deposit (CD). A CD is a type of savings account that locks in your money for a certain period of time. In exchange for locking in your money, you will earn a higher interest rate than you would with a traditional savings account.

A money market account. A money market account is a type of savings account that offers higher interest rates than a traditional savings account. However, there are usually some restrictions on how often you can withdraw money from a money market account.

VI. How to track your sinking fund?

It is important to track your sinking fund so that you can see how close you are to reaching your goal. There are a few different ways to track your sinking fund.

You can use a budgeting app or software. Many budgeting apps and software programs allow you to track your sinking funds.

You can create a spreadsheet. You can also create a spreadsheet to track your sinking funds.

You can simply keep track of your savings in a notebook

| Sinking Fund | Reserve Fund |

|---|---|

| What is it? | A sinking fund is a savings account that is set aside to pay for a specific future expense. |

| Why do you need it? | To pay for unexpected expenses, such as a car repair or medical bill. |

| How to create it? | Set up a separate savings account and contribute money to it on a regular basis. |

| How much money should you put in it? | Enough to cover the expected expense. |

What is a sinking fund?

A sinking fund is a savings account that you set aside specifically to pay for a large, future expense. For example, you might use a sinking fund to save for a down payment on a house, a new car, or a major home repair.

Sinking funds are a great way to save for expensive items that you know you’ll need in the future. They can help you avoid taking on debt, and they can give you peace of mind knowing that you’re prepared for upcoming expenses.

III. How to create a sinking fund?

There are a few different ways to create a sinking fund. You can use a dedicated savings account, a separate investment account, or a line of credit.

If you use a dedicated savings account, you will need to set up a separate account and make regular deposits into it. You can use this account to save up for specific expenses, such as a down payment on a house or a new car.

If you use a separate investment account, you will need to invest your money in a safe investment, such as a bond fund or a certificate of deposit. This will help you to grow your money over time, so that you will have more to cover your future expenses.

If you use a line of credit, you will need to have a credit card or a personal loan that you can use to borrow money when you need it. This is a good option if you need to cover unexpected expenses, such as a medical bill or a car repair.

No matter which method you choose, it is important to make regular deposits into your sinking fund so that you can save up for your future expenses.

II. Why do you need a sinking fund?

A sinking fund is a savings account that you set up specifically to pay for a large, future expense. This could be anything from a down payment on a house to a new car to a major home repair. By setting aside money each month, you can gradually build up a nest egg that will help you cover the cost of these expenses without having to put yourself in debt.

There are many reasons why you might want to have a sinking fund. Here are a few of the most common:

- To save for a down payment on a house.

- To pay for a new car.

- To cover the cost of a major home repair.

- To pay for a child’s education.

- To cover the cost of a medical emergency.

Having a sinking fund can give you peace of mind knowing that you have the money set aside to cover these expenses when they arise. It can also help you avoid taking on debt, which can save you money in the long run.

V. Where to keep your sinking fund?

There are a few different options for where to keep your sinking fund. You can choose to keep it in a savings account, a CD, or a money market account. Each option has its own advantages and disadvantages, so you should choose the one that best meets your needs.

Here is a comparison of the three options:

| Option | Advantages | Disadvantages |

|---|---|---|

| Savings account |

|

|

| CD |

|

|

| Money market account |

|

|

Ultimately, the best place to keep your sinking fund depends on your individual needs and circumstances. If you need easy access to your money, a savings account is probably the best option. If you are willing to lock in your money for a higher interest rate, a CD may be a better choice. And if you want a balance between accessibility and interest rate, a money market account may be a good option.

VI. How to track your sinking fund?

There are a few different ways to track your sinking fund. You can use a simple spreadsheet, a budgeting app, or a dedicated sinking fund app.

If you’re using a spreadsheet, you can create a table with the following columns:

- Category

- Amount

- Date

Each time you make a deposit to your sinking fund, you can add a new row to the table. You can also use the spreadsheet to track the total amount of money in your sinking fund and the progress you’re making towards your goals.

If you’re using a budgeting app, you can usually set up a sinking fund as a separate category. This will allow you to track your deposits and withdrawals from the fund, as well as the total amount of money in the fund.

If you’re using a dedicated sinking fund app, the app will typically track all of the information for you. You can simply enter the amount of each deposit and withdrawal, and the app will keep track of the total amount of money in the fund.

No matter which method you choose, it’s important to track your sinking fund so that you can make sure it’s on track and that you’re reaching your goals.

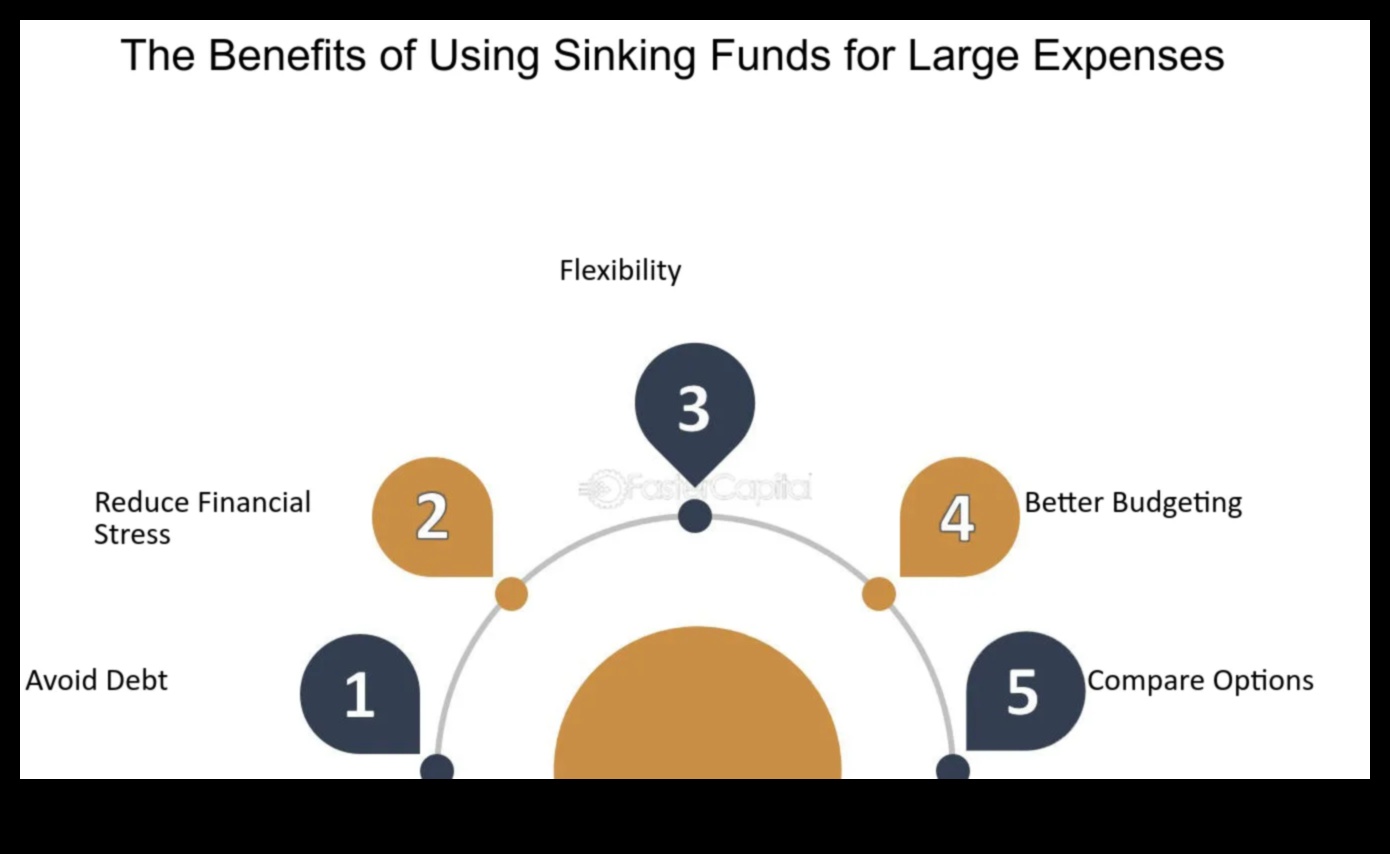

VII. What are the benefits of having a sinking fund?

There are many benefits to having a sinking fund, including:

- It can help you save money for unexpected expenses.

- It can give you peace of mind knowing that you have money set aside for future repairs or replacements.

- It can help you avoid debt by paying for major expenses with cash instead of borrowing money.

- It can help you improve your credit score by showing lenders that you are responsible with your money.

If you are not already using a sinking fund, I encourage you to start one today. It is a simple and effective way to save money and prepare for the unexpected.

What are the risks of having a sinking fund?

There are a few risks associated with having a sinking fund, including:

The risk of oversaving. If you save too much money in your sinking fund, you may not be able to access it when you need it. This could lead to financial hardship if you have an unexpected expense.

The risk of undersaving. If you don’t save enough money in your sinking fund, you may not be able to cover the cost of a major expense. This could lead to debt or financial difficulty.

The risk of inflation. If the value of your money decreases due to inflation, the amount of money in your sinking fund may not be enough to cover the cost of a major expense.

The risk of market volatility. If the value of your investments decreases, the amount of money in your sinking fund may not be enough to cover the cost of a major expense.

How to use a sinking fund for retirement?

A sinking fund is a savings account that you set aside specifically for a future expense. It can be used for anything from a down payment on a house to a new car. When it comes to retirement, a sinking fund can be used to cover unexpected expenses, such as medical bills or home repairs. It can also be used to supplement your retirement income or to pay off debt.

Here are some tips for using a sinking fund for retirement:

- Decide how much you want to save each month.

- Set up a separate savings account for your sinking fund.

- Automate your contributions so that money is automatically transferred from your checking account to your sinking fund each month.

- Track your progress so that you can see how much you are saving each month.

- Review your sinking fund goals regularly and adjust them as needed.

A sinking fund can be a valuable tool for helping you reach your retirement goals. By setting aside money each month, you can be prepared for unexpected expenses and can also boost your retirement savings.

What are sinking funds

A sinking fund is a savings account that you set aside specifically for a future expense. It can be used to pay for anything from a down payment on a house to a new car. Sinking funds are a great way to save for large expenses and avoid debt.

Why do you need a sinking fund?

There are many reasons why you might need a sinking fund. Here are a few of the most common:

- To pay for a down payment on a house

- To buy a new car

- To cover unexpected expenses

- To pay for retirement

How to create a sinking fund?

Creating a sinking fund is easy. Here are the steps involved:

- Decide how much money you want to save each month.

- Open a savings account specifically for your sinking fund.

- Automate your savings so that a certain amount of money is transferred from your checking account to your sinking fund each month.

- Track your progress and make sure you are on track to reach your savings goal.

How much money should you put in a sinking fund?

The amount of money you should put in a sinking fund depends on your financial goals and your budget. However, a good rule of thumb is to save at least 3-6 months of living expenses. This will help you cover unexpected expenses and avoid debt.

Where to keep your sinking fund?

You can keep your sinking fund in any type of savings account. However, it is important to choose an account that is safe and secure. Some good options include:

- A high-yield savings account

- A certificate of deposit (CD)

- A money market account

How to track your sinking fund?

Tracking your sinking fund is important to make sure you are on track to reach your savings goal. Here are a few ways to track your progress:

- Use a budgeting app or software

- Create a spreadsheet

- Keep track of your savings in a notebook

What are the benefits of having a sinking fund?

There are many benefits to having a sinking fund. Here are a few of the most important:

- You can save for large expenses without going into debt.

- You can avoid stress and anxiety about unexpected expenses.

- You can reach your financial goals faster.

What are the risks of having a sinking fund?

There are a few risks associated with having a sinking fund. Here are a few of the most important:

- Your money is not accessible as quickly as it would be in a checking account.

- Your money is subject to inflation.

- You may not earn as much interest as you would in other investments.

How to use a sinking fund for retirement?

A sinking fund can be a great way to save for retirement. Here are a few tips on how to use a sinking fund for retirement:

- Set a goal for how much you want to save for retirement.

- Decide how much you can afford to save each month.

- Automate your savings so that a certain amount of money is transferred from your checking account to your sinking fund each month.

- Track your progress and make sure you are on track to reach your savings goal.

FAQ

Q: What is the difference between a sinking fund and an emergency fund?

A sinking fund is a savings