Scholarship Considered Income

The search intent of “is a scholarship considered income” is to determine whether or not scholarships are considered taxable income. This is a common question for students and their families, as scholarships can provide a significant financial benefit. However, it is important to understand the tax implications of scholarships in order to avoid any surprises.

There are a few different factors that determine whether or not a scholarship is considered taxable income. These factors include:

- The type of scholarship

- The amount of the scholarship

- The student’s filing status

Taxable scholarships include scholarships that are awarded for academic achievement, athletic ability, or other extracurricular activities. Non-taxable scholarships include scholarships that are awarded based on financial need. Scholarships that are worth less than $5,250 are generally not taxable. However, scholarships that are worth more than $5,250 may be taxable, depending on the other factors listed above.

Students who are claimed as dependents on their parents’ taxes may have to include some or all of their scholarship income on their parents’ tax return.

It is important to note that scholarships are not the same as grants. Grants are not considered taxable income, regardless of the amount or type of grant.

If you are unsure whether or not a scholarship is taxable, you should consult with a tax advisor.

| Feature | Answer |

|---|---|

| Scholarship Considered Income | Some scholarships are considered taxable income, while others are not. Taxable scholarships include scholarships that are awarded for academic achievement, athletic ability, or other extracurricular activities. Non-taxable scholarships include scholarships that are awarded based on financial need. |

| Tax Implications of Scholarships | The taxability of a scholarship depends on the type of scholarship, the amount of the scholarship, and the student’s filing status. |

| How Scholarships are Taxed | Taxable scholarships are taxed as ordinary income. Non-taxable scholarships are not taxed. |

| Scholarships and FAFSA | Scholarships are considered financial aid for FAFSA purposes. |

| Scholarships and Financial Aid | Students who receive scholarships may have to reduce their financial aid award by the amount of the scholarship. |

Scholarship Considered Income

Scholarships are not considered taxable income, regardless of the amount or type of scholarship. This is because scholarships are considered to be gifts, and gifts are not taxed.

However, there are a few exceptions to this rule. If a scholarship is used to pay for room and board, the amount of the scholarship that is used for room and board is considered to be taxable income. Additionally, if a scholarship is used to pay for tuition and fees, the amount of the scholarship that is used for tuition and fees is considered to be taxable income if the student’s adjusted gross income exceeds $95,000.

If you are unsure whether or not a scholarship is taxable, you should consult with a tax advisor.

II. Tax Implications of Scholarships

There are a few different tax implications of scholarships. These include:

- Scholarships are considered taxable income, unless they are awarded based on financial need.

- The amount of the scholarship that is taxable depends on the student’s filing status.

- Students who are claimed as dependents on their parents’ taxes may have to include some or all of their scholarship income on their parents’ tax return.

- Scholarships may be subject to federal income tax withholding.

It is important to note that scholarships are not the same as grants. Grants are not considered taxable income, regardless of the amount or type of grant.

If you are unsure whether or not a scholarship is taxable, you should consult with a tax advisor.

II. Tax Implications of Scholarships

There are a few different tax implications of scholarships. These include:

Scholarships are considered taxable income. This means that you must report the amount of your scholarship income on your tax return.

The amount of your scholarship income that is taxable depends on your filing status. Students who are claimed as dependents on their parents’ taxes may have to include some or all of their scholarship income on their parents’ tax return.

Scholarships that are used to pay for tuition and fees are not taxable. This is because tuition and fees are considered to be a qualified education expense.

Scholarships that are used to pay for room and board, books, and other expenses are taxable. However, you may be able to claim a deduction for these expenses on your tax return.

If you have any questions about the tax implications of your scholarship, you should consult with a tax advisor.

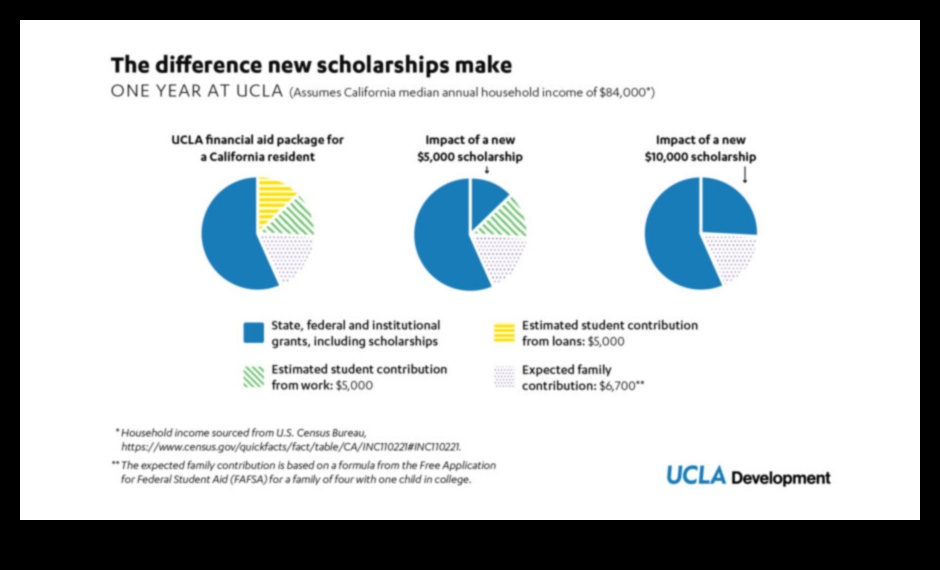

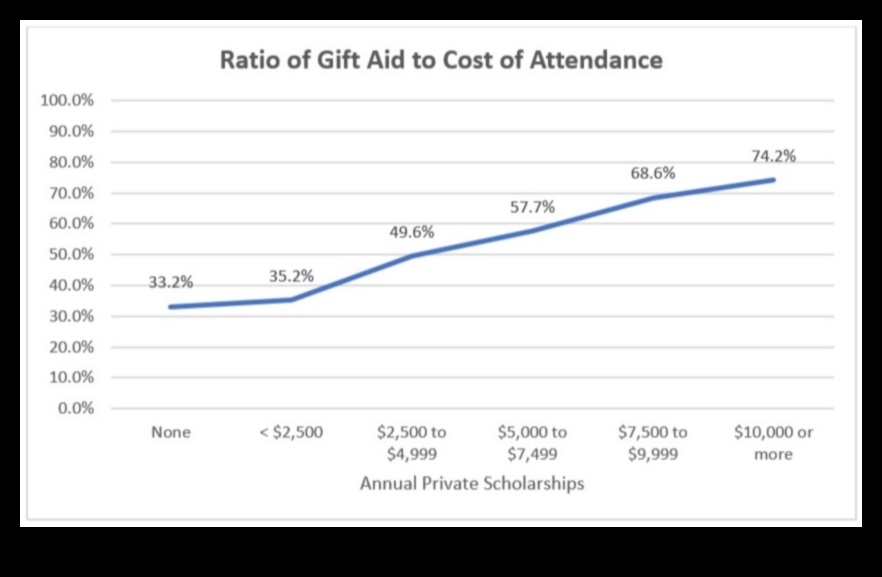

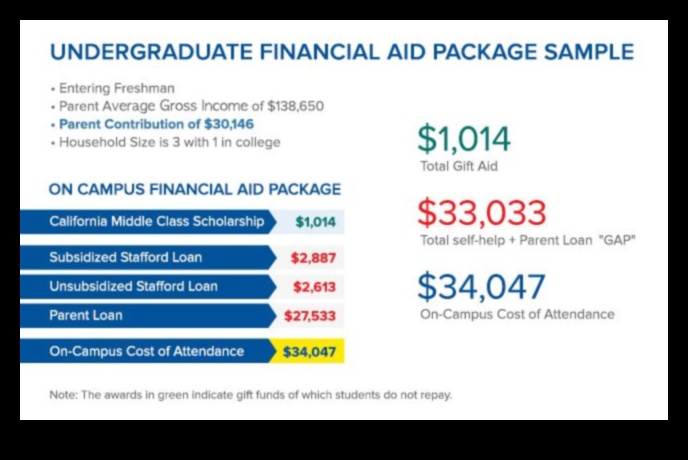

V. Scholarships and Financial Aid

Scholarships can be a great way to help pay for college, but they can also affect your eligibility for financial aid. Here are a few things to keep in mind:

Scholarships are considered income when you apply for financial aid. This means that they will reduce the amount of financial aid you qualify for.

The amount of financial aid you lose will depend on the type of scholarship you receive. Taxable scholarships will reduce your financial aid more than non-taxable scholarships.

You may be able to claim a tax deduction for some scholarships. This can help offset the amount of financial aid you lose.

It is important to carefully consider the financial aid implications of accepting a scholarship before you make a decision. You may want to consult with a financial aid advisor to help you make the best decision for your situation.

VI. Scholarships and Taxes for International Students

International students who receive scholarships must pay taxes on the income they earn from those scholarships. The amount of tax they owe depends on their filing status and the amount of their scholarship income.

International students who are claimed as dependents on their parents’ taxes must include their scholarship income on their parents’ tax return. The parents can then claim the scholarship as an education tax deduction.

International students who are not claimed as dependents on their parents’ taxes must file their own tax return. They can claim the scholarship as an education tax credit.

The amount of the education tax deduction or credit that an international student can claim depends on their filing status and the amount of their scholarship income.

For more information on the tax implications of scholarships for international students, please consult with a tax advisor.

VII. Scholarships and Taxes for Graduate Students

As a graduate student, you may be wondering whether or not your scholarships are taxable. The answer to this question depends on a few factors, including the type of scholarship you receive and your filing status.

Taxable scholarships: Scholarships that are awarded for academic achievement, athletic ability, or other extracurricular activities are considered taxable income. This includes scholarships that are awarded by colleges and universities, as well as scholarships that are awarded by private organizations.

Non-taxable scholarships: Scholarships that are awarded based on financial need are not considered taxable income. This includes scholarships that are awarded by the federal government, as well as scholarships that are awarded by state governments or private organizations.

How much of your scholarship is taxable?

The amount of your scholarship that is taxable depends on your filing status. If you are single and file your taxes as a single person, you will have to pay taxes on the first $5,250 of your scholarship income. If you are married and file your taxes jointly, you will have to pay taxes on the first $10,500 of your scholarship income.

What if I have other sources of income?

If you have other sources of income, such as a job or a part-time job, you may be able to claim a deduction for your scholarship income. The amount of the deduction you can claim depends on your filing status and your other sources of income.

If you are unsure whether or not your scholarship is taxable, you should consult with a tax advisor.

Scholarships and Taxes for Students with Disabilities

Students with disabilities may be eligible for a number of tax breaks and deductions related to their scholarships. These include:

* The American Opportunity Tax Credit (AOTC): The AOTC is a tax credit that can be claimed for the first four years of college or post-secondary education. The credit is worth up to $2,500 per year, and it can be claimed for both tuition and fees. Students with disabilities who are enrolled at least half-time are eligible for the AOTC.

* The Lifetime Learning Credit (LLC): The LLC is a tax credit that can be claimed for any year of college or post-secondary education. The credit is worth up to $2,000 per year, and it can be claimed for both tuition and fees. Students with disabilities who are enrolled at least half-time are eligible for the LLC.

* The student loan interest deduction: Students with disabilities who are paying interest on student loans may be eligible to deduct the interest from their taxes. The deduction is worth up to $2,500 per year.

* The tuition and fees deduction: Students with disabilities who are paying tuition and fees may be eligible to deduct the amount from their taxes. The deduction is worth up to $4,000 per year.

In addition to these tax breaks and deductions, students with disabilities may also be eligible for other financial assistance, such as scholarships and grants. For more information, please visit the IRS website or contact a tax advisor.

IX. Scholarships and Taxes for Students with Children

Students who have children may be eligible for certain tax deductions and credits that can help offset the cost of raising children. These deductions and credits include:

- The Child Tax Credit

- The Earned Income Tax Credit

- The Child and Dependent Care Credit

For more information on these deductions and credits, please visit the IRS website.

X. FAQ

Q: Are scholarships considered income?

A: Some scholarships are considered taxable income, while others are not. Taxable scholarships include scholarships that are awarded for academic achievement, athletic ability, or other extracurricular activities. Non-taxable scholarships include scholarships that are awarded based on financial need.

Q: How much is a scholarship worth?

A: The amount of the scholarship can also affect its taxability. Scholarships that are worth less than $5,250 are generally not taxable. However, scholarships that are worth more than $5,250 may be taxable, depending on the other factors listed above.

Q: What is the student’s filing status?

A: The student’s filing status can also affect the taxability of a scholarship. Students who are claimed as dependents on their parents’ taxes may have to include some or all of their scholarship income on their parents’ tax return.